African cross-border fintech startup Chipper Cash has closed a $13.8 million Series A funding round led by Deciens Capital and plans to hire 30 new staff globally.

The raise caps an event filled run for the San Francisco based payments company, founded two years ago by Ugandan Ham Serunjogi and Ghanaian Maijid Moujaled.

The two came to America for academics, met in Iowa while studying at Grinnell College and ventured out to Silicon Valley for stints in big tech: Facebook for Serunjogi and Flickr and Yahoo! for Moujaled.

The startup call beckoned and after launching Chipper Cash in 2018, the duo convinced 500 Startups and and Liquid 2 Ventures — co-founded by American football legend Joe Montana — to back their company with seed funds.

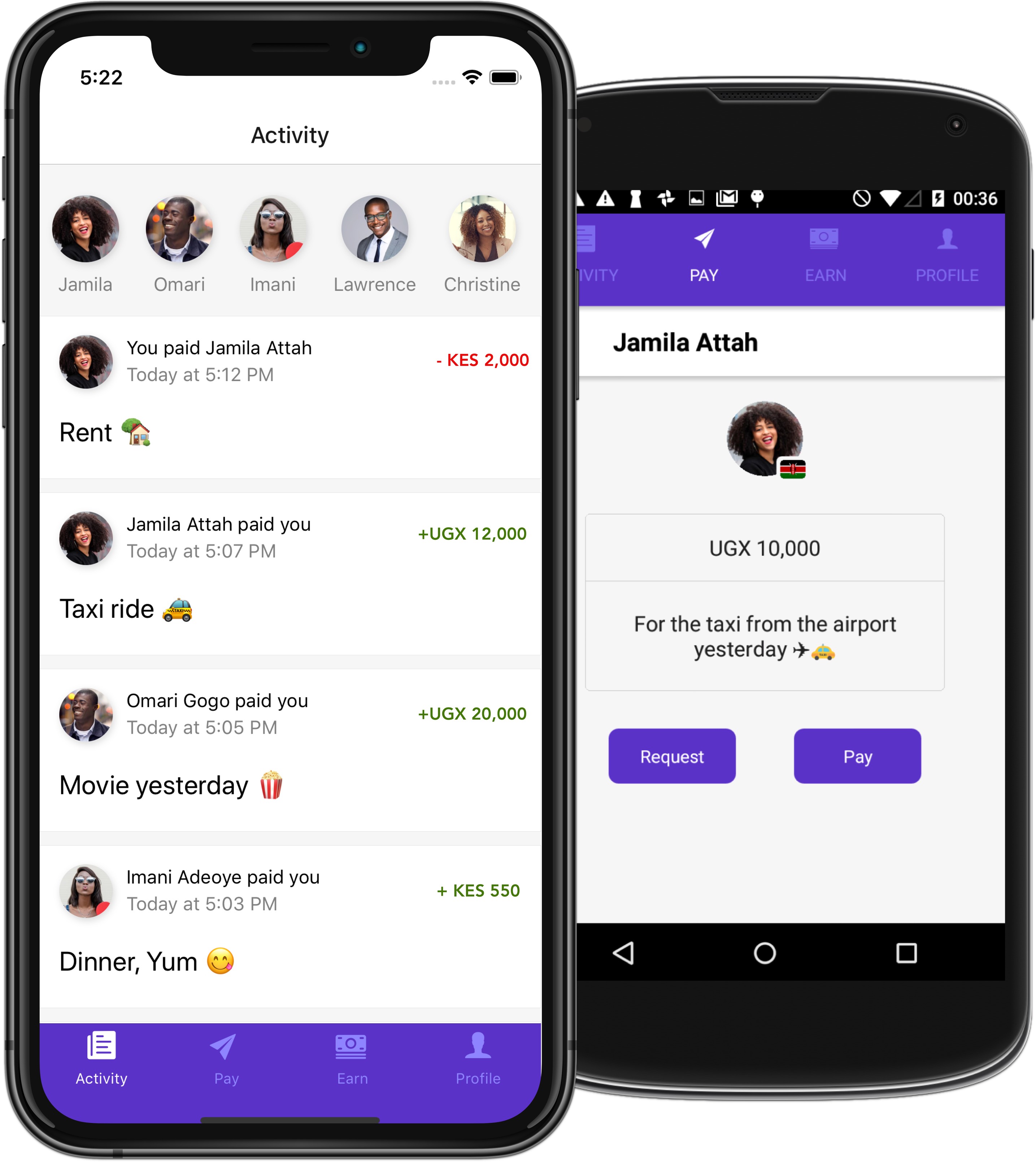

Two years and $22 million in total capital raised later, Chipper Cash offers its mobile-based, no fee, P2P payment services in seven countries: Ghana, Uganda, Nigeria, Tanzania, Rwanda, South Africa and Kenya.

“We’re now at over one and a half million users and doing over a $100 million dollars a month in volume,” Serunjogi told TechCrunch on a call.

Chipper Cash does not release audited financial data, but does share internal performance accounting with investors. Deciens Capital and Raptor Group co-led the startup’s Series A financing, with repeat support from 500 Startups and Liquid 2 Ventures .

Deciens Capital founder Dan Kimmerling confirmed the fund’s lead on the investment and review of Chipper Cash’s payment value and volume metrics.

Parallel to its P2P app, the startup also runs Chipper Checkout: a merchant-focused, fee-based mobile payment product that generates the revenue to support Chipper Cash’s free mobile-money business.

The company will use its latest round to hire up to 30 people across operations in San Francisco, Lagos, London, Nairobi and New York — according to Serunjogi.

Image Credits: Chipper Cash

Chipper Cash has already brought on a new compliance officer, Lisa Dawson, whose background includes stints with the U.S. Department of Treasury’s Financial Crimes Enforcement Network and Citigroup’s anti-money laundering department.

“You know in the world we live in the AML side is very important so it’s an area that we want to invest in from the get go,” said Serunjogi.

He confirmed Dawson’s role aligned with getting Chipper Cash ready to meet regulatory requirements for new markets, but declined to name specific countries.

With the round announcement, Chipper Cash also revealed a corporate social responsibility component to its business. Related to current U.S. events, the startup has formed the Chipper Fund for Black Lives.

“We’ve been huge beneficiaries of the generosity and openness of this country and its entrepreneurial spirit,” explained Serunjogi. “But growing up in Africa, we’ve were able to navigate [the U.S.] without the traumas and baggage our African American friends have gone through living in America.”

The Chipper Fund for Black Lives will give 5 to 10 grants of $5,000 to $10,000. “The plan is to give that to…people or causes who are furthering social justice reforms,” said Serunjogi.

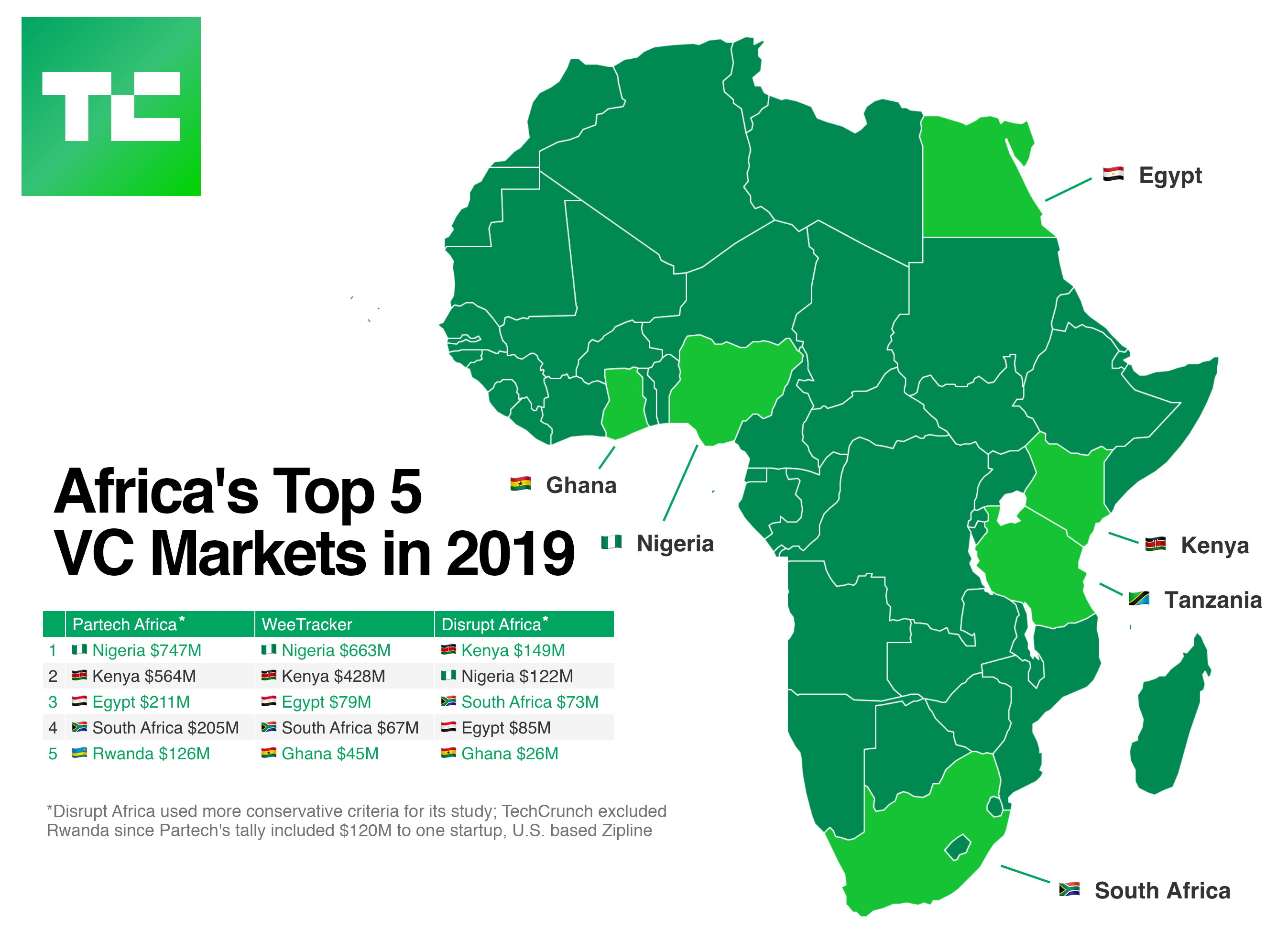

In Africa, Chipper Cash has placed itself in the continent’s major digital payments markets. As a sector, fintech has become Africa’s highest funded tech space, receiving the bulk of an estimated $2 billion in VC that went to startups in 2019.

Image Credits: TechCrunch

Those ventures, and a number of the continent’s established banks, are in a race to build market share through financial inclusion.

By several estimates — including The Global Findex Database — the continent is home to the largest percentage of the world’s unbanked population, with a sizable number of underbanked consumers and SMEs.

Increasingly, Nigeria has become the most significant fintech market in Africa, with the continent’s largest economy and population of 200 million.

Chipper Cash expanded there in 2019 and faces competition from a number of players, including local payments venture Paga. More recently, outside entrants have jumped into Nigeria’s fintech scene.

In 2019, Chinese investors put $220 million into OPay (owned by Opera) and PalmPay — two fledgling startups with plans to scale first in West Africa and then the broader continent.

Over the next several years, expect to see market events — such as fails, acquisitions, or IPOs — determine how well funded fintech startups, including Chipper Cash, fare in Africa’s fintech arena.