WASHINGTON — The British government and Indian mobile network operator Bharti Global placed the winning bid to acquire OneWeb, a broadband megaconstellation startup that filed for Chapter 11 bankruptcy protection in March after running out of funding, OneWeb said July 3.

OneWeb said it has secured $1 billion in new funding — $500 million from the British government to “deliver first UK sovereign space capability,” and another $500 million from Indian mobile network operator Bharti Global — to recapitalize its constellation effort.

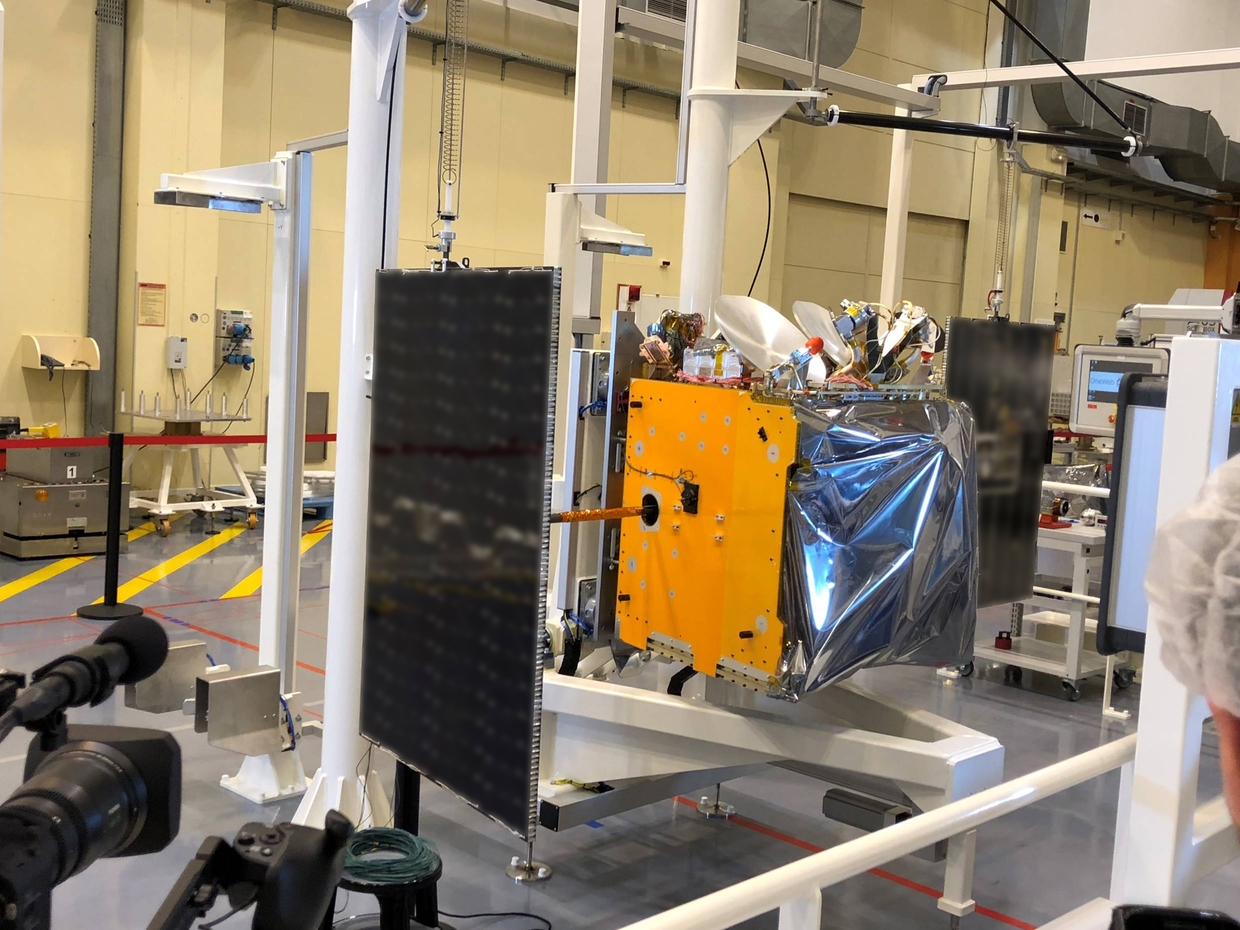

OneWeb, in a news release, said the funding will “effectuate the full end-to-end deployment of the OneWeb system,” but did not specify if that system is the original 650-satellite constellation the company was pursuing prior to bankruptcy. OneWeb has 74 satellites in low Earth orbit.

“This deal underlines the scale of Britain’s ambitions on the global stage,” Alok Sharma, business secretary for the British government, said in a separate July 3 release from the U.K. Department for Business, Energy and Industrial Strategy. “Our access to a global fleet of satellites has the potential to connect millions of people worldwide to broadband, many for the first time, and the deal presents the opportunity to further develop our strong advanced manufacturing base right here in the UK.”

The British government will lead a consortium with Bharti to complete the purchase, which is expected to close in the fourth quarter of 2020, subject to approval by the U.S. Bankruptcy Court for the Southern District of New York. Bharti is expected to provide commercial and operational leadership to OneWeb, plus revenue leveraging its base of more than 425 million customers.

“With differentiated and flexible technology, unique spectrum assets and a compelling market opportunity ahead of us, we are eager to conclude the process and get back to launching our satellites as soon as possible,” OneWeb Chief Executive Adrian Steckel said in a news release.

OneWeb had raised $3.4 billion in equity and debt to fund its broadband constellation, but ran into financial difficulty after failing to convince SoftBank, its largest backer, to invest additional capital. Arianespace had completed three of an expected 21 Soyuz launches for OneWeb prior to the startup’s bankruptcy proceedings.

The U.K. government said ownership of OneWeb will enable the U.K. to “further develop its advanced manufacturing base,” an ambition that could result in shifting OneWeb satellite manufacturing to the U.K.

Richard Franklin, managing director of Airbus Defence and Space U.K., said the company is eager to work with OneWeb.

“The U.K. government’s vision in backing this project will drive innovation and new ways of thinking about how space can contribute even more to the U.K. economy, and the country’s defence requirements, as well as playing a part in delivering broadband internet to communities across the country,” he said in a July 3 statement. “We look forward to supporting OneWeb in the next phase of their business and growing the UK contribution to this market changing business.”

Airbus spokesperson Jeremy Close declined to comment on the possibility that manufacturing of OneWeb’s satellites will now move to the U.K. from Florida. OneWeb Satellites, the joint venture of OneWeb and Airbus tasked with building OneWeb’s constellation, did not immediately respond to a SpaceNews inquiry about the number of satellites it will henceforth produce for OneWeb.

The U.K. government said that as the owner of OneWeb, it will have “final say over any future sale of the company, and over future access to OneWeb technology by other countries on national security grounds.”