Nearly 300 space executives from 195 companies filled a University of Colorado auditorium in late July to hear the U.S. Space Force talk about its needs for space domain awareness. Known as SDA, space domain awareness is the military term for space situational awareness, which means knowledge of the space environment. The Air Force Space Command in a 2019 memo said the Defense Department would use the term SDA to convey the message that the military now views space as a domain of war, like sea, air and land.

“In a warfighting domain, in addition to knowing what an object in orbit is, we want to know its intent,” F Schnell, senior materiel leader for space domain awareness at U.S. Space Systems Command, told SpaceNews.

The Space Systems Command, the procurement arm of the Space Force that hosted the industry meeting, stood up an office dedicated to SDA when it reorganized earlier this year.

A key user of SDA technologies is U.S. Space Command. One of its units, the 18th Space Defense Squadron, tracks objects in orbit and issues collision warnings in its role as global space traffic coordinator. DoD plans to hand over some of that responsibility to the U.S. Commerce Department over the next few years so military space operators can focus on SDA.

SDA is more complex than traditional space traffic management, Schnell said. It requires tracking objects, analyzing their characteristics, and discriminating benign from aggressive activities in orbit.

The Space Force wants to augment the government’s own capabilities with data and analytics tools developed by the private sector, said Schnell. “The technologies that our commercial partners are bringing are absolutely getting after what we need,” he added.“They have matured their capabilities to get after the characterization problem.”

Following the July briefing in Colorado, the Space Systems Command invited companies for one-on-one meetings. “I was really amazed by their capabilities,” Schnell said. “A lot of them are building truly commercial use cases and funding structures, with the Space Force being a portion of it, but not the majority of their use cases. So that was wonderful to see.”

More meetings are scheduled later this month in Hawaii at the Advanced Maui Optical and Space Surveillance Technologies (AMOS) conference, Schnell said. Maui is home to the 15th Space Surveillance Squadron, a unit of the Space Force’s Space Delta 2 that operates military telescopes.

U.S. Space Command, meanwhile, has created other avenues for SDA vendors to get noticed by military buyers. The DRAGON Army program, short for Defense Readiness Agile Gaming Online Network, provides a virtual sandbox where selected companies can bring their software to the command’s Joint Task Force-Space Defense commercial operations cell. These 14-day software sprint events are held in Colorado Springs three times a year.

DRAGON Army participants also get access to officials from the Commerce Department’s Office of Space Commerce who attend these sprint events as they evaluate commercial data sources for a future civilian space traffic management system.

The Space Systems Command is buying commercial space data for the unified data library, a data repository and online marketplace that can be accessed by defense and intelligence agencies, and will support the Commerce Department’s civilian space traffic management effort.

Schnell said the Space Force will continue its market research as it considers procurement strategies to buy commercial SDA services.

“What business models are out there and how we can best leverage those business models is part of the ongoing conversation,” he said. “The priority for Space Systems Command is to exploit all the data that we have, buy what we can, and build only what we must.”

‘VENDOR LOCK’ A CONCERN

Brian Weeden, director of program planning at the Secure World Foundation, said a key obstacle preventing DoD from leveraging commercial space technology, including SDA, is fear of vendor lock-in. DoD doesn’t want to become dependent on one specific service or technology — or find that switching vendors is cost prohibitive.

“It’s a problem with a lot of the existing DoD procurement programs,” Weeden told SpaceNews. If the government agrees to buy a system from a contractor, typically only that contractor can do software upgrades and maintenance, “and it makes it hard to shop around.”

As the military looks to leverage the commercial space market, buyers worry that if they pick one or two companies and give them large contracts, they will disincentivize other players from continuing to invest and innovate. Weeden said the government, in order to capitalize on private investment, has to send a demand signal to the industry so investors stay in the game.

Despite vendor lock-in concerns, if the Pentagon wants to keep vendors around, it will need to award contracts for products and services, Weeden added. For nearly a decade, the Pentagon has been talking about using commercial space data, he said, but the rhetoric has not been matched by action. In the SDA sector, “you can’t point to a large contract that the government has given to a commercial entity.”

Given the security challenges in the space domain and the proliferation of anti-satellite technology, DoD should accelerate the use of commercial SDA services, said Weeden, who served in the U.S. Air Force as a space control officer.

In the early 2000s, the only data that could be had on space objects was the general location, said Weeden. “If an object was tracked by one of the missile warning radars, we could get a radar cross section that would indicate its general size. That was all the information we had. And I suspect it hasn’t gotten much better for the teams currently assigned to this mission.”

Since then, commercial SDA technology has advanced in leaps and bounds. “Now you’ve got more than a dozen companies that have their own telescopes, have their own radars, their own other kinds of phenomenology, that are building their own space catalog and doing a lot of really impressive things.”

The government, meanwhile, “is still struggling to figure out how to leverage that commercial innovation,” Weeden noted. If DoD selects multiple vendors to support SDA, it will not be in a vendor lock-in situation.

To build a profitable business, companies must offer more than just raw data, he said, as the value is in the analysis and insights sold as a subscription service. “Everyone wants to get that recurring subscription income, with more guaranteed revenue.”

He noted that in the SDA market, a lot of data is available for free from the U.S. military, which maintains the space tracking catalog and provides conjunction warnings at no cost. This, in some ways, puts the government in competition with the private sector.

DEMAND FOR SURVEILLANCE

Several developments in space over the past several months have raised alarms across the space and national security communities. Events such as Russia blowing up a satellite in low Earth orbit, China deploying a spacecraft with a robotic arm, and a Russian vehicle reportedly stalking a U.S. spy satellite have gotten the Pentagon’s attention.

A panel of advisers to the secretary of defense, the Defense Policy Board, is scheduled to receive classified briefings this month on Chinese and Russian space weapons and space policy doctrine, according to a Federal Register notice.

Space Force deputy chief of space operations, Lt. Gen. B. Chance Saltzman, said the military needs to “understand potential adversaries on orbit, their capabilities, their weapons, their operations, tactics and intentions.”

Saltzman, nominated to be the next four-star chief of the Space Force, said in a speech at the GEOINT Symposium in Denver this spring that the ability to prove who did what in space is necessary in order to deter aggressive behavior. “I think it’s time we start considering attribution as a military mission,” he said.

Eric Desautels, acting deputy assistant secretary of state for arms control, verification and compliance, said intelligence about space objects today is not precise enough to be able to differentiate between benign and potentially nefarious activities.

A ground-launched missile aimed at a low-orbiting spacecraft is clearly an anti-satellite weapon, he said. But other systems now being deployed in space are dual use. A case in point is the Chinese satellite that a private company, ExoAnalytic Solutions, detected docking with a defunct spacecraft in December. China called it a debris removal system, but some U.S. officials said it was a demonstration of an anti-satellite weapon.

“Defining what a weapon in space is is very challenging,” Desautels said Aug. 24 at a space policy conference in Washington. “We haven’t gotten there yet … we observe behaviors and try to determine intent.”

Space policy experts worry that if a space vehicle is inaccurately characterized, tensions could escalate and lead to broader conflict.

In a recent report on the U.S. space industrial base, experts from the Defense Innovation Unit, the Air Force, and Space Force said the government needs to bring in commercial solutions to fill increasingly complex needs for SDA.

“There remains a significant lack of coverage, both in the number of sensors and the orbital diversity and geometry of those sensors,” said the report. “Comprehensive SDA means responsive detection, characterization, and custody in order to update the catalog and dependent models faster.”

The report warned the U.S. is “not postured to adequately execute intelligence and space traffic management missions.”

INDUSTRY IN WAIT-AND-SEE MODE

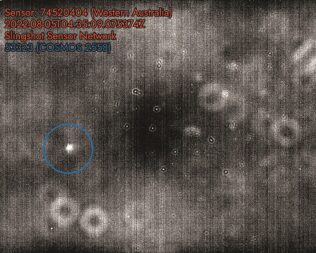

The private sector for years has been investing in SDA capabilities and is hoping the government will buy services at scale, said Melanie Stricklan, co-founder and CEO of Slingshot Aerospace.

Slingshot recently acquired Numerica, a company that operates a network of optical space sensors and has participated in the Space Command commercial cell’s demonstrations.

“We help the government understand how they could use that data. But I think they’ve got to do that faster,” said Stricklan. “It’s not getting any safer on orbit.”

Companies keep hearing the government is not ready to sign contracts due to concerns about vendor lock-in, said Stricklan, noting that she doesn’t believe these worries are justified. To understand the space environment, DoD will need to work with a diversity of suppliers, she said. “You need a layered approach to space domain awareness so that we can get those predictive models.”

Space Force and Space Command are now far more knowledgeable about the capabilities of the industry due to activities like the commercial cell and DRAGON Army, said Stricklan. But they need to find a way to keep working with companies beyond experiments and small business research projects. “What the government perceives as vendor lock is a myth,” she said. “When you subscribe to something, just like on your iPhone, you’re not in a vendor lock situation.”

Siamak Hesar, co-founder and CEO of Kayhan Space, said companies see signals from the Space Force that they are interested in commercial capabilities. “But I wish they would accelerate that process because we have been discussing this for quite a while now,” he said. “We keep hearing conversations, but we haven’t seen any notable action.”

Kayhan developed a collision-avoidance software platform that automatically tells a client satellite how to maneuver to avoid a threat. Hesar said the company has over a dozen customers and has won small-business research grants from DoD, but so far, no government contracts to buy the service.

At the industry meeting the Space Systems Command hosted in Colorado, “there was a lot of discussion about utilizing commercial capabilities,” but how that will be implemented remains unclear, Hesar said.

A common fear in the industry is that the Space Force will try to “reinvent the wheel” and develop systems in-house that already exist in the commercial world, Hesar said.

Space Command leaders, for example, have publicly voiced concerns that the 18th Space Defense Squadron crews are overworked due to the proliferation of satellites and debris. This is an area where commercial systems can provide immediate help, Hesar said. “We have a tool that can do conjunction assessments autonomously.”

If DoD doesn’t move forward with contracts, “some companies might get frustrated and go and sell their services to Europe or Middle Eastern countries,” Hesar said.

Activities like the DRAGON Army sprint exercises are helpful, he said, but it can be costly for small businesses to support government demonstrations on their own dime, in addition to their normal day-to-day operations.

Hesar said the government can take advantage of proven and available commercial capabilities. “And if one fails or one goes down, there are others,” he added. The cost to acquire multiple commercial services will still be “faster and cheaper than building stuff from scratch.”

Ghonhee Lee, founder and CEO of Katalyst Space Technologies, said commercial companies want to see the government “shift their contractual vehicles to take advantage of data-as-a-service models.”

Katalyst is one of eight startups selected in July for a Space Force-funded accelerator focused on SDA technologies. The three-month accelerator is currently underway at the Catalyst Campus in Colorado Springs.

Lee’s company developed a sensor payload aimed at the commercial market for in-space docking and satellite servicing. But until demand picks up for commercial services, the company is focused on the military market.

Katalyst is offering an SDA sensor that could be installed on any satellite. Lee said the Space Force has agreed to test the payload on an experimental satellite in geostationary orbit projected to launch in 2024.

The project is an example of how the Space Force could use commercial technology to keep an eye on threats in orbit, said Lee. These dual-use systems are attractive to commercial investors that demand multiple use cases, said Lee. “We can use our payload for debris monitoring and to help the Space Force track threats in orbit.”

With funding from U.S. Air Force small business innovation research contracts, Katalyst developed software to help characterize objects in orbit, said Lee. “Using advanced algorithms, we can get considerable intelligence about a spacecraft and help with the attribution element, which is obviously very important.”

This article originally appeared in the September 2022 issue of SpaceNews magazine.