Semiconductor stocks rose on Wednesday on the back of AMD’s strong earnings report and following the Federal Reserve’s decision to increase the federal funds rate by 0.25 percentage point.

Although the Fed said it expects ongoing rate increases, it also said that inflation has eased somewhat, causing a rally in riskier stocks such as chipmakers.

AMD stock gained over 12% on Wednesday. Nvidia advanced 8%, Qualcomm rose under 4%, and Broadcom gained 3%. Intel, which reported disappointing earnings last month, rose less than 3%. GlobalFoundries, an independent chip manufacturer, rose over 6%.

The VanEck Semiconductor ETF, which tracks a basket of chip stocks, was up 4.7% on Wednesday.

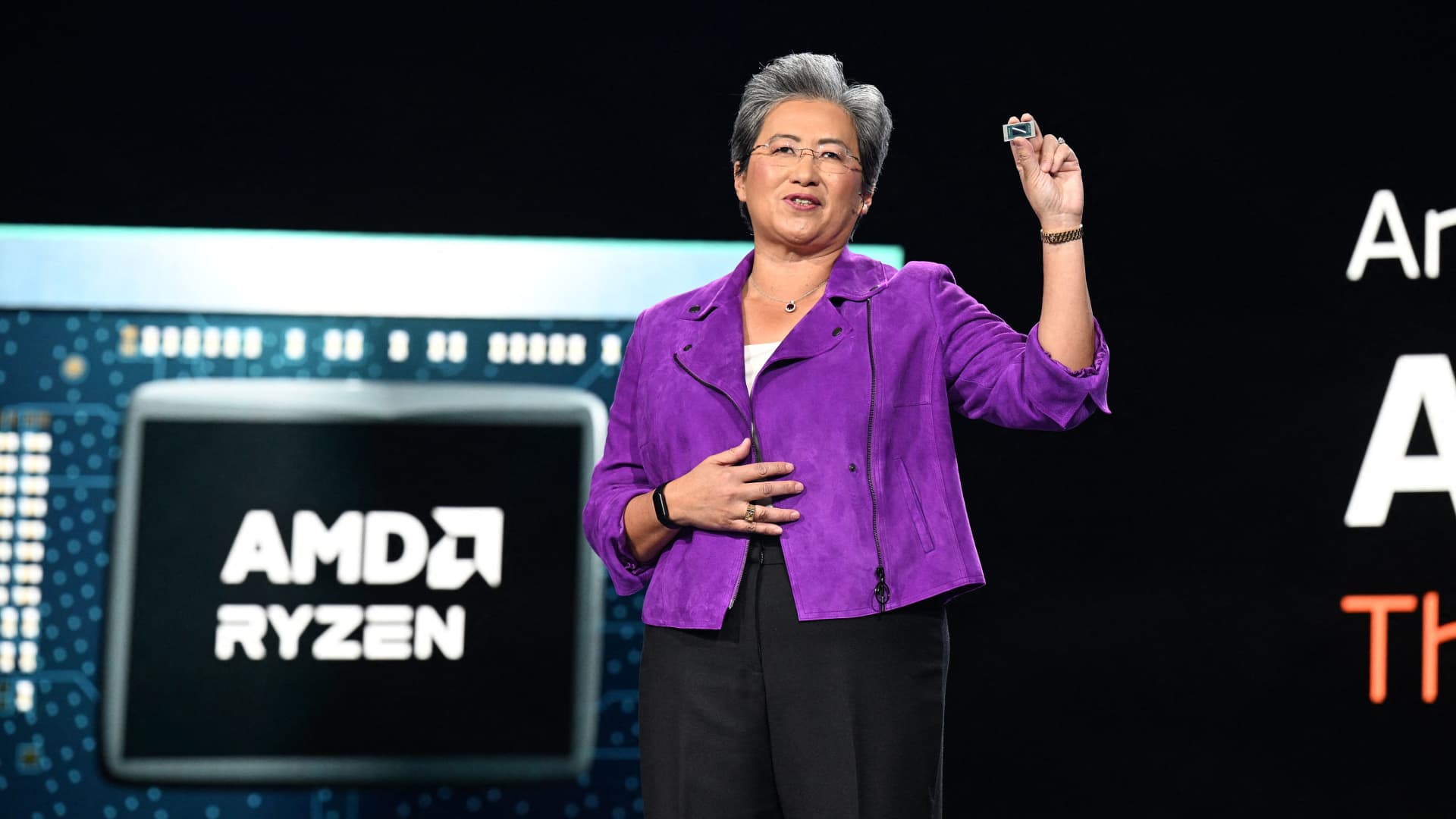

On Tuesday, AMD reported December quarter earnings that beat expectations. The company indicated a weak outlook for the January quarter, though was more optimistic about demand in the second half of 2023.

Still, AMD’s report had a much rosier outlook on the overall semiconductor market than Intel’s earnings report in January, which suggested collapsing demand for its products.

The semiconductor industry is dealing with several problems at the moment, including a glut of extra parts at PC and server makers, and falling prices for certain components like memory and central processors.