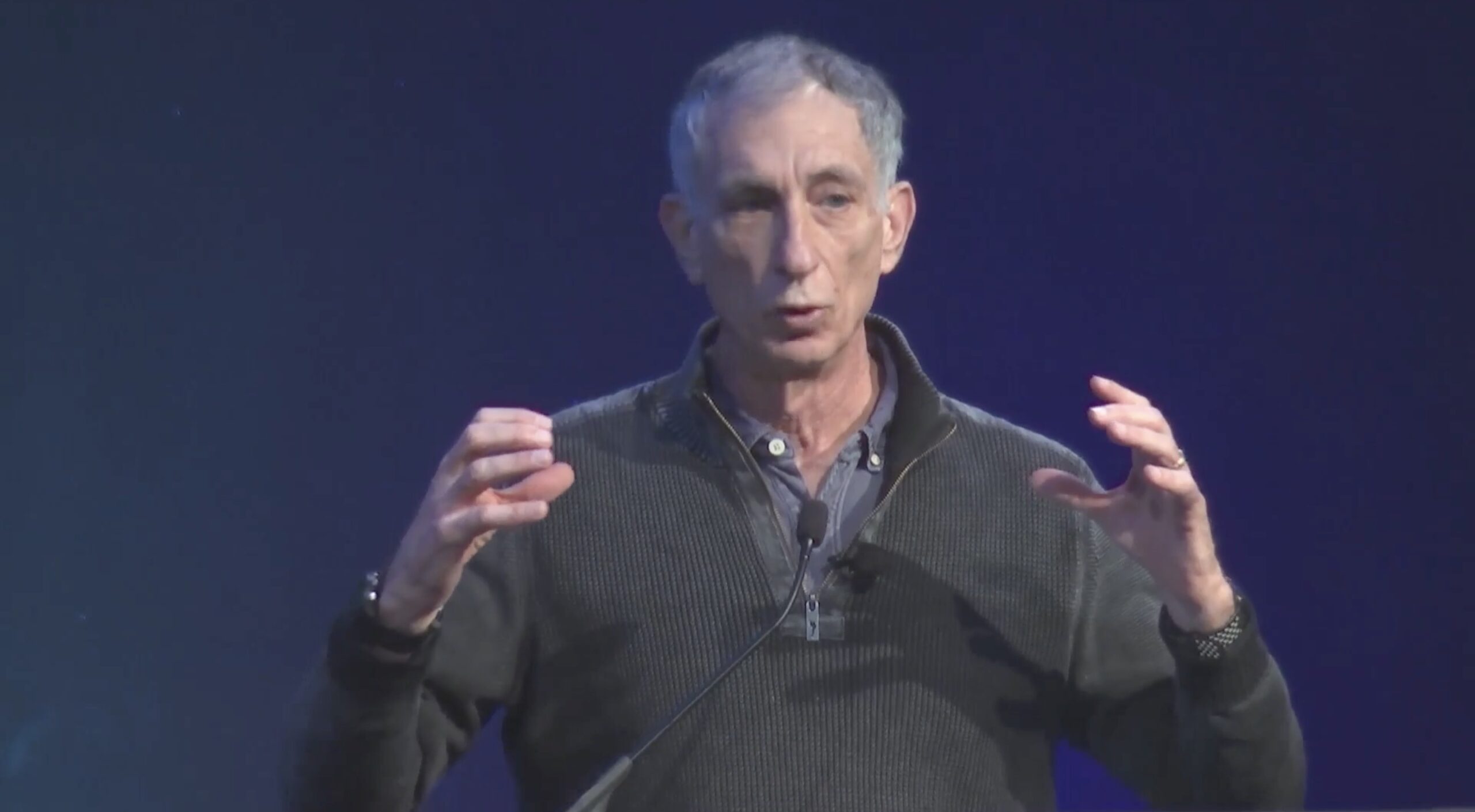

TAMPA, Fla. — Viasat is exploring hybrid narrowband direct-to-smartphone services using satellites in geostationary and non-geostationary orbits, CEO Mark Dankberg said Feb. 8.

There is “plenty that can be done both at GEO as well as at non-GEO,” Dankberg said while addressing the SmallSat Symposium in Mountain View, California, and “what we’re really looking at is a harmonized system between the two.”

During Viasat’s financial results call yesterday, Dankberg said the GEO broadband operator is open to partnering with low Earth orbit (LEO) companies, including arch-rival SpaceX.

“Personally, we don’t rule out partnering with anybody,” he said in response to an analyst question about allying with SpaceX, “but I think we’ve shown that we can really add value in the space architectures more than we could just in lease fees for spectrum as an example — but, we never say never.”

Viasat is closing in on its acquisition of British GEO broadband and narrowband operator Inmarsat, which has global L-band spectrum rights and plans for a LEO constellation.

Dankberg told the SmallSat Symposium that while Viasat made its mulit-billion dollar offer for Inmarsat because of its international broadband presence, its direct-to-smartphone narrowband capabilities are increasingly compelling.

He said “one of the biggest potential markets is direct-to-device,” which is “going to have a big influence, both positive and negative, when it comes to … the self-interest of nations.”

Advances in technology and telecoms protocol standardization are making it easier to communicate to and from orbit without large antennas or specialized phones.

“It’s possible to control that,” Dankberg said, “but when any cell phone in the world, or smartwatch … within your borders can connect to a space system directly, that is not consistent with the self-interest of quite a few nations in the world.”

As direct-to-smartphone efforts pick up and capabilities advance beyond emergency messaging, he sees other knock-on effects across the rest of the space industry.

These include more mass being put into orbit, increasing the threat of debris-causing collisions threatening the viability of space operations for all operators.

Small LEO satellites have been getting larger to improve their capabilities as launch economics improve, Dankberg noted.

He pointed to how SpaceX’s Starlink broadband satellites have increased from about 250 kilograms to the 2,000-kilogram range to add new capabilities, such as direct-to-smartphone services, into its second-generation broadband constellation.

Viasat believes “you do not need very large satellites to accomplish missions in space,” Dankberg said, and is focusing on improving payload integration to save space.

“We’re looking at standardized cubesat-type form factors that we think we can buy that will create a vibrant ecosystem,” he added, “to allow many new entrants into these into these systems.”

Viasat is still waiting on regulatory approvals from the United Kingdom and European to buy Inmarsat after announcing the deal in November 2021.

The statuary deadline for the U.K.’s competition watchdog to decide on the deal is March 30, Raymond James analyst Ric Prentiss said in a recent investor note, and “then the last remaining hurdle would be the European Commission which could potentially elongate the timeline.”

Viasat, which recently completed the $2 billion sale of its tactical data communications business, reported $651 million in revenue from continuing operations in the three months to the end of December, up 4% year-on-year.

Adjusted EBITDA, or earnings before interest, taxes, depreciation and amortization, declined 15% to $139 million.

The operator also disclosed an extra few weeks of delays for its debut next-generation ViaSat-3 satellite, designed to add significant amounts of capacity over the Americas, which is now slated for a SpaceX Falcon Heavy launch in the week of April 8.

The second ViaSat-3, covering Europe, Middle East, and Africa, is counting down to a September launch on one of United Launch Alliance’s last Atlas launches.