The government of the U.S. Virgin Islands in a court filing Friday estimated that it will seek damages of at least $190 million from JPMorgan Chase in a lawsuit accusing the big bank of facilitating sex trafficking by its former long-time customer Jeffrey Epstein.

The Virgin Islands also said it wants an order requiring JPMorgan to take a series of steps to protect young women and girls from other predators in the future.

“These sets of recommendations aim to address the same core problem: JPMorgan’s knowledge of

and failure to report Epstein’s trafficking because it lacked the economic incentive and motivation

to place compliance with the law and prevention of trafficking ahead of its own profits,” the filing in U.S. District Court in Manhattan says.

The American territory also said it will seek further compensatory damages specifically for victims of Epstein beyond the nearly $300 million JPMorgan agreed to pay victims last month to settle a lawsuit by one of his accusers. The filing did not give an amount for those additional damages.

The new filing came in response to a request last week by Judge Jed Rakoff that the territory detail the damages it seeks in the case as it heads toward a scheduled Oct. 23 trial.

The Virgin Islands’ suit accuses JPMorgan of benefiting from Epstein’s trafficking of young women to be abused by him and others during the 15 years he was a client of the bank, which is the largest in the United States.

The complaint alleges JPMorgan allowed Epstein to keep many millions of dollars in accounts at the bank, which he used to fund his trafficking of women, despite multiple red flags about him raised by bank employees over the years.

JPMorgan, which had no immediate comment Friday, has repeatedly denied any wrongdoing in the case.

“We are pursuing this enforcement action because JPMorgan Chase’s institutional failure enabled Jeffrey Epstein’s sex trafficking, and JPMorgan Chase must make significant changes to detect, report and stop human trafficking,” said U.S. Virgin Islands Attorney General Ariel Smith in a statement Friday.

“Financial penalties, as well as conduct changes, are important to make sure that JPMorgan Chase knows the cost of putting its own profits ahead of public safety,” said Smith.

She said that if the Virgin Islands wins its suit, it will uses the monetary damages it receives “to support efforts to strengthen, inform, and expand local law enforcement and enhance the Virgin Islands’ services for victims of human trafficking and other victims of crime.”

The filing says the Virgin Islands wants at least $150 million in civil penalties alone. The filing also says that it wants JPMorgan to disgorge at least another $40 million in fees that Epstein generated for the bank, and that JPMorgan received from “many ultra-high net worth clients” he referred to the bank.

Those clients, the filing said, included Google co-founder Sergey Brin, Microsoft founder Bill Gates, Lex Wexner, the founder of Limited Brands, and the billionaire Glenn Dubin.

In addition to the monetary damages, the Virgin Islands also is asking JPMorgan be compelled “to implement new policies, including separating its business and compliance functions and designating an independent compliance consultant, to prevent human trafficking,” according to a press release by Smit’s office.

JPMorgan in its own court filings has accused the Virgin Islands itself of being “complicit in the crimes of Jeffrey Epstein.”

The bank alleges Epstein gave high-ranking officials there money, advice and favors in exchange for looking the other way when he trafficked young women to be abused there.

Epstein had a residence on a private island in the territory, where accusers say he and other people sexually abused them.

Last month in the same court where the Virgin Islands is suing the bank JPMorgan agreed, without admitting wrongdoing, to pay $290 million to victims of Epstein to settle a suit by one of his accusers.

In May, Deutsche Bank agreed to pay Epstein victims $75 million to settle a separate lawsuit by an accuser who accused that back of abetting his sex trafficking of her and others. Deutsche Bank took on Epstein as a customer after JPMorgan severed ties with him in 2013, years after bank employees first voiced concerns about him.

Deutsche Bank previously agreed to pay New York state’s Department of Financial Services a $150 million penalty for failure to detect or prevent millions of dollars of suspicious transactions related to Epstein, which included “payments to Russian models and to numerous women with Eastern European surnames,” the filing Friday by the Virgin Islands noted.

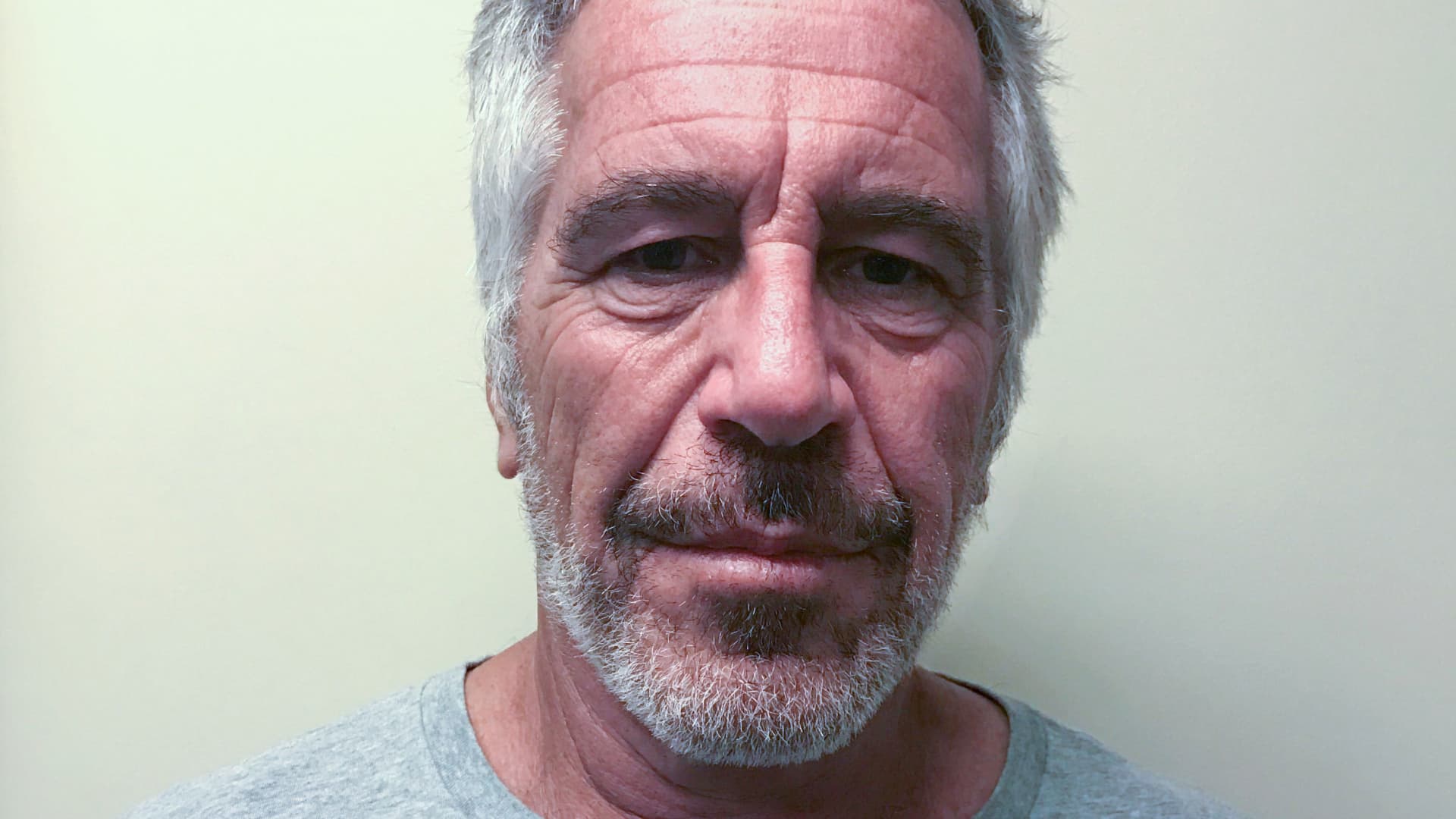

Epstein, who had been a friend to former Presidents Donald Trump and Bill Clinton, as well as Prince Andrew of Great Britain, pleaded guilty in 2008 to a Florida state charge of soliciting sex from an underage girl. He served 13 months in jail, but spent much of that time on work release each day.

Epstein, then 66, killed himself in a federal jail in New York in August 2019, a month after he was arrested on federal child sex trafficking charges.