Bob Iger, CEO, Disney at the Allen & Company Sun Valley Conference on July 11, 2023 in Sun Valley, Idaho

David A. Grogan | CNBC

Disney shareholders overwhelmingly voted to keep the company’s current board intact during Wednesday’s annual meeting, suggesting they believe current CEO Bob Iger has a plan to boost shares and install a strong successor.

Now, Iger will have to prove it, or he risks facing yet another activist campaign this time next year.

Iger can show progress in a number of areas over the next 12 months. That starts with turning his streaming services into a profitable unit, explaining ESPN’s digital strategy, scoring some box-office hits and picking a successor with a transition plan.

If Disney struggles to show investors the entertainment giant has a coherent strategy, or if Iger kicks the succession can down the road once more, activist investors may be knocking on the company’s door again during next year’s annual meeting to demand change.

“They still have the same problems they’ve had before, which are really industry problems,” said TD Cowen analyst Doug Creutz. “Direct-to-consumer streaming is just economically inferior to the old linear bundle model, which is going away. They have to try to manage through that.”

‘Turning Red’ … to black

Still from Pixar’s “Turning Red.”

Disney

Disney said earlier this year it plans to turn a profit in its streaming TV businesses in its fiscal fourth quarter this year.

That would mark a milestone for the company, which launched Disney+ on Nov. 12, 2019. It would be the first time Disney showed it can make money from Disney+, Hulu and ESPN+.

Disney will need to sustain and grow streaming profit to justify Iger’s five-year-old strategy to go “all in” on the segment.

Iger’s confidence that Disney will make streaming profitable by the end of the fiscal year stems from draconian cost-cutting on content, which includes new movies, sports rights spending and TV production. Disney said in November it was targeting an “annualized entertainment cash content spend reduction target” of $4.5 billion.

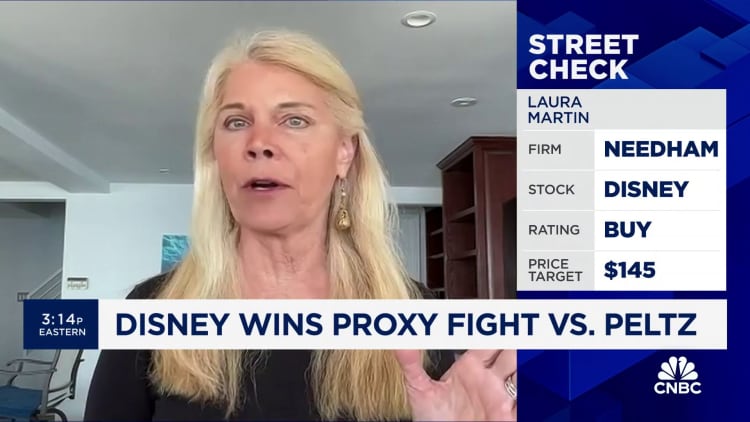

“What they have to do next is fix the streaming losses,” said Needham & Co. analyst Laura Martin. “They still need to cut costs on the streaming side to get to profitability.”

ESPN’s strategy

Disney has set up a two-pronged digital strategy for ESPN. For decades, Disney reaped billions by keeping ESPN exclusive to the cable bundle.

Those days are nearly over.

In the fall of 2024, Disney plans to launch a skinny sports bundle that includes ESPN’s linear network, along with sports channels from Warner Bros. Discovery and Fox. The yet-to-be-priced digital streaming service will likely cost about $45 or $50 per month, CNBC reported in February. Disney owns one-third of it.

ESPN will then debut its own flagship streaming service in the fall of 2025. It will include new personalized features that cater to sports bettors and fantasy sports players. The Athletic reported last month that service is likely to cost $25 or $30 per month.

Disney risks confusing consumers with its multiple offers and will need to roll out its new products with clear messaging. Disney has already offered ESPN+, a sports streaming service that has some but not all of ESPN’s content. That costs $10.99 per month and can be bundled with Disney+ and Hulu.

The Disney+ website on a laptop in Brooklyn, New York, on July 18, 2022.

Gabby Jones | Bloomberg | Getty Images

ESPN will also stay an essential part of the cable bundle. Subscribers will want to know what they’re paying for and what content they do and don’t get with their additional subscription dollars.

Box-office turnaround

Disney has been mired in a yearslong box-office slump, from live-action flops to Pixar disappointments, from Marvel fatigue to the absence of Star Wars (the last movie released in theaters came in 2019).

Disney hired David Greenbaum, previously co-president of Searchlight, on Feb. 26 to take over as president of Walt Disney Motion Picture Studios, replacing Sean Bailey. He’ll report to Disney Entertainment co-Chairman Alan Bergman, who is on the hot seat to change the division’s fortunes.

Other than 2022â²s “Avatar: The Way of Water,” which Disney acquired as part of its $71 billion deal for the majority of 21st Century Fox, the company has not had a movie generate more than $1 billion since the last Star Wars release in 2019, according to data from Comscore. Sony produced and distributed “Spider-Man: No Way Home,” which made $1.9 billion, although Disney’s Marvel Studios did serve as a co-producer.

Several big-budget franchise films have flopped. “Indiana Jones and the Dial of Destiny” in 2023 generated $378 million globally. “Ant-Man and the Wasp: Quantumania” secured $476 million worldwide, unusually low for a Marvel film (until “The Marvels” reached just over $200 million late last year). And Pixar’s “Lightyear” collected less than $250 million globally in 2022.

Trian Partners’ Nelson Peltz, who failed to join Disney’s board Wednesday after securing just 31% of the vote, publicly questioned what he has called Disney’s “woke” content strategy. The company’s creative team has actively sought to create films and television shows centered on people of color as well as exploring narratives outside heteronormativity.

“People go to watch a movie or a show to be entertained,” Peltz said in an interview with the Financial Times. “They don’t go to get a message.”

Iger said Wednesday that while the company wants to instill positive messages into its content, that shouldn’t be the first priority.

“Our job is to entertain first and foremost, and by telling great stories,” Iger said during the company’s annual shareholder meeting. “We continue to have a positive impact on the world and inspire future generations, just as we’ve done for over 100 years.”

Success on succession

The biggest existential question for Disney is who follows Iger as CEO. This was Trian’s strongest argument to land Peltz a board seat. Iger has five times pushed back his retirement as CEO, and when he did leave in 2020, he stuck around as chairman for 22 months, butting heads with his successor Bob Chapek as the two jockeyed to co-run the company during the pandemic.

Iger returned in late 2022 as the CEO when the board fired Chapek. Iger’s plan to hand over Disney to a new leader has been to name a successor in or around early 2025 and then stick around to teach that person the job, CNBC reported last year.

He’ll want to make sure that person is prepared to run an expansive company, with a flourishing parks business, a declining legacy TV unit, a still young streaming division, and a struggling but legendary movie studio. Internal candidates include Bergman, ESPN Chairman Jimmy Pitaro, Parks and Resorts Chairman Josh D’Amaro, and Disney co-chairman of entertainment Dana Walden, who could be the first female CEO in the company’s 100-year history.

“The problem is how do you replace Bob Iger? They’ve been trying to do it for 10 years, and it’s very difficult for multiple reasons,” said TD Cowen’s Creutz. “Bringing someone from the outside into Disney, which has a very strong, unique culture, is risky. Then you’re down to internal candidates, and if there isn’t anyone internally you think can step into the role, you’ve got a problem.”

The board has now been given the greenlight to proceed with its search process. That’s a win for Iger, and shareholders voted Wednesday they believe it’s a win for them, too.

â CNBC’s Sarah Whitten contributed to this report.

WATCH: Disney still needs to cut costs on streaming side to get to profitability, says Needman’s Martin

Read the original article here