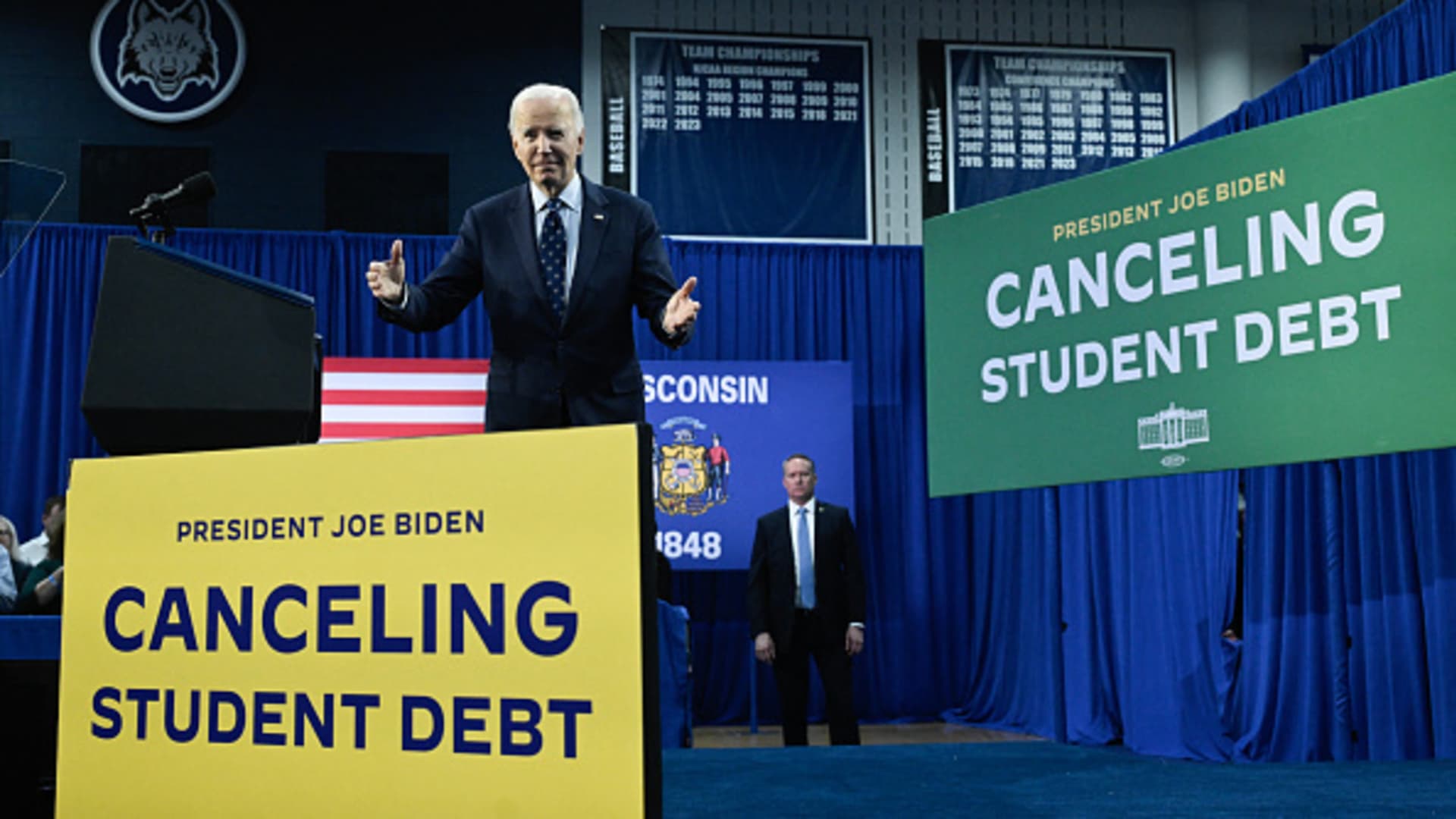

US President Joe Biden gestures after speaking about student loan debt relief at Madison Area Technical College in Madison, Wisconsin, April 8, 2024.Â

Andrew Caballero-Reynolds | AFP | Getty Images

The Biden administration has published its new student loan forgiveness proposal, putting it on the path to start clearing debt for millions of borrowers this fall.

The public has 30 days, through May 17, to comment on the details of the revised aid package.

Since the U.S. Supreme Court rejected President Joe Biden‘s first attempt at wide-scale loan cancellation last summer, his administration has been working on this do-over plan.

Biden wants the program to survive legal challenges this time. To that end, the U.S. Department of Education has made the relief more targeted and turned to the regulatory process. The president initially attempted to forgive student debt through an executive action.

Outstanding federal education debt in the U.S. stands at around $1.6 trillion, and burdens Americans more than credit card or auto debt. More than 40 million people hold student loans.

Here’s what to know about Biden’s new relief plan.

What the revised plan calls for

While Biden’s previous relief plan forgave student debt for most borrowers, this aid package targets specific groups of people, and the interest on the loans.

It calls to cancel “the full amount” of someone’s debt that has grown from their original balance when they first entered repayment. To qualify for this provision, these borrowers would also need to be enrolled in one of the Education Department’s income-driven repayment plans and to earn under a certain amount, including $120,000 or less as a single filer.

Regardless of their income, borrowers would be eligible for up to $20,000 in cancellation on the portion of their debt that is unpaid interest.

Consumer advocates have long criticized the fact that interest rates on federal student loans may exceed 8%, which can make it tough for borrowers who fall behind or are on certain payment plans to reduce their balances.

More than 25 million federal student borrowers owe more than they originally borrowed, according to the Biden administration.

More from Personal Finance:

FAFSA ‘fiasco’ could cause decline in college enrollment

Harvard is back on top as the ultimate ‘dream’ school

More of the nation’s top colleges roll out no-loan policies

Borrowers who have been in repayment for 20 years or longer on their undergraduate loans, or more than 25 years on their graduate loans, would get full debt cancellation.

The plan also erases the debt of people who are already eligible for that relief but haven’t received it or applied for it. Such stories are common.

Lastly, it delivers relief to borrowers who enrolled and took out debt to attend low-financial-value schools and programs or institutions that failed to provide sufficient financial value.

The Education Department left out from its relief proposal, for now, the group of borrowers experiencing financial hardship. Previously, its plan was expected to include people in this situation.

“As President Biden said last week, our Administration is working as quickly as possible to deliver relief to as many borrowers as possible,” an Education Department spokesperson said in a statement.

As a result, while it continues to create a proposal for those struggling financially, it moved forward “with these proposed rules today so we can begin delivering relief to borrowers as early as this fall,” the spokesperson said.

And what comes next …

After the 30-day public comment period, the Biden administration needs to review the feedback it received for its plan. It will then release its final rule, probably at some point this summer. Soon after, it could begin reducing and eliminating borrowers’ balances.

However, legal challenges could disrupt that timeline.

After Biden first touted his revised relief program on April 8, Missouri Attorney General Andrew Bailey, a Republican, wrote on X that the president “is trying to unabashedly eclipse the Constitution.”

“See you in court,” Bailey wrote.

Read the original article here