TAMPA, Fla. — AST SpaceMobile is continuing to search for funds ahead of deploying commercial direct-to-device satellites next year after getting more breathing room with a $60 million discounted share sale.

Some 12.5 million shares were sold June 27 at around $4.75 each, about 27% less than where they were trading before the sale announcement, topping up the company’s cash reserves to roughly $200 million.

The Texas-based startup last announced a share sale in November to raise at least $75 million — a year and a half after getting around $417 million through its IPO — following manufacturing delays and cost overruns for the satellites it is building in-house.

AST SpaceMobile said it is currently burning through cash at a rate of about $40 million every three months.

In addition, the venture expects to use between $15 million and $25 million per quarter for non-launch-related capital expenditures, which it said may fluctuate over time.

AST SpaceMobile also expects to pay around $45 million to $50 million over the next three months for launch and related services.

“Given the substantial capital needs of our business and business plans, we are in discussions with various financing sources to enhance liquidity and may raise additional funds from such sources after completion of this offering,” AST SpaceMobile said in a regulatory filing.

Potential funding options include debt and more sales of equity, including to strategic companies.

AST SpaceMobile has a strong track record of attracting strategic investment, with investors to date including Japanese technology conglomerate Rakuten and Vodafone, the largest pan-European and African telecoms company.

But in a regulatory filing to clarify statements an AST SpaceMobile executive gave financial news service MergerMarket, which reported June 12 that the venture was “racing forward” with potential strategic partners, the startup said it had not yet received commitments from any of them.

AST SpaceMobile chief financial officer Sean Wallace said it has not “entered into any agreement with respect to financing from strategic partners and no such transaction with a strategic partner is imminent.”

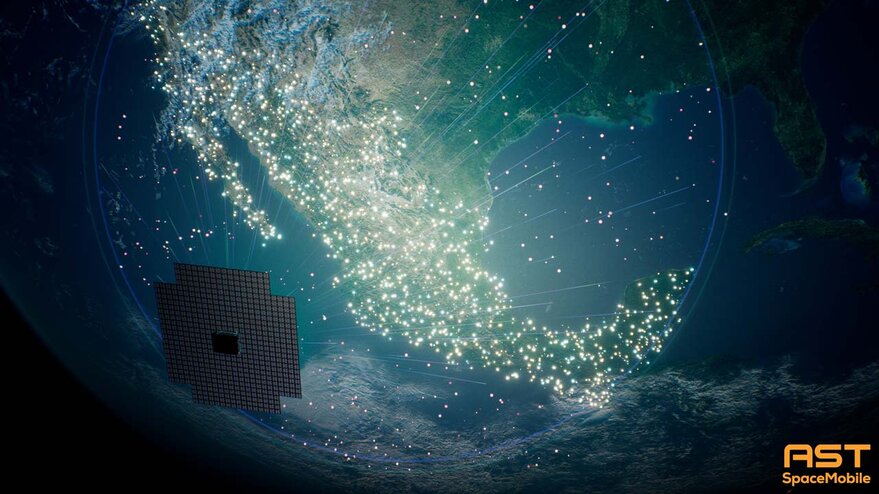

SpaceX is slated to launch AST SpaceMobile’s first five commercial satellites early next year, although it is unclear how quickly the venture could ramp up its business as it and others in the emerging direct-to-device market await regulatory clearances.

AST SpaceMobile announced June 21 that multiple everyday smartphones had achieved 4G LTE download speeds during tests with BlueWalker 3, the company’s prototype that SpaceX launched to low Earth orbit in September.

The venture announced its first BlueWalker 3-enabled first voice call with a standard smartphone April 25, helping send shares on an upward trajectory until recently.

The shares are currently trading at around $4.70 on NASDAQ, down about 30% from where they were the day before AST SpaceMobile announced its latest share sale.