Source: Bank of America

Big restaurant chains have largely recovered from the coronavirus pandemic, but the rest of the industry is taking longer to bounce back, according to a Bank of America study.

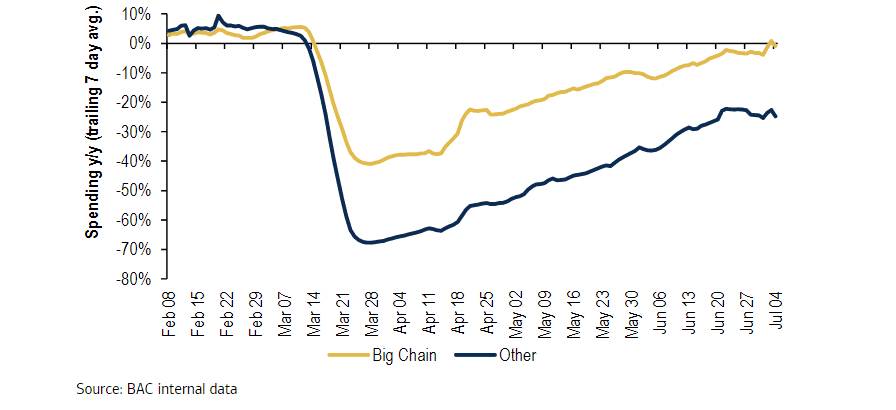

Analysts Gregory Francfort and JonMichael Shekian used aggregated transaction data from Bank of America credit and debit cardholders to analyze consumers’ restaurant spending habits. On July 1, the trailing seven-day average spend at large chain restaurants was down 4% compared with the year-ago period. At small restaurant chains and independents, spending fell 25%.

Small chains and independent eateries tend to be casual dining and fast-casual establishments, while large chain restaurants range from full service to fast food. The closure of dining rooms and the shift to social distancing has hit the casual dining and fast-casual segments harder. According to Francfort and Shekian, that explains “some of the gap between Big Chain and Other in the data.”

In mid-April, the difference in spending between big chains and the rest of the industry was even wider, peaking in the low-30% range. Fast-food CEOs, like McDonald’s Chris Kempczinski, have said that consumers return to their drive-thru lanes looking for familiar comfort food.

Trade groups have issued dire warnings about the future of independent restaurants. A report commissioned by the Independent Restaurant Coalition, which is pushing for a $120 billion bailout fund for independent bars and eateries, found that as much as 85% of independent restaurants could permanently close by the end of the year.

And as coronavirus cases surge in some regions of the U.S., restaurants are once again taking a hit.

“It is quite evident in our industry checks that COVID-19 spikes in key states in the West and Southeast have weighed on industry sales since the third week of June,” Francfort and Shekian wrote.

They expect that more casual dining and fast-casual restaurants will close compared with fast-food locations, which could benefit Darden Restaurants and Chipotle Mexican Grill.

“These are two companies with strong balance sheets that are flexing capital availability advantages as well as scale advantages,” the research note said.

Darden, which has a market value of $9.2 billion, has seen its stock fall nearly 35% since the start of the year. Chipotle shares, meanwhile, have risen more than 33% since January, bring its market cap to $31.1 billion.