GUANGZHOU, China — China’s technology sector has taken a wild ride over the past year, with regulations tightened, billions of dollars wiped off companies’ market value, and a continuing push from Beijing for technological self-sufficiency.

Those are among the important themes that will be addressed at CNBC’s annual East Tech West event in the Nansha district of Guangzhou in southern China.

Here’s a look at the top concerns and focuses of China’s technology sector right now.

China’s tech crackdown

In November 2020, what would have been a world record-setting initial public offering of fintech giant Ant Group was suspended.

Following that, Beijing introduced a slew of new rules in areas from antitrust for internet platforms and a bolstered data protection law. Both e-commerce giant Alibaba and food delivery firm Meituan have faced antitrust fines.

That has weighed heavily on China’s internet names. For example, Alibaba’s shares are down 41% year-to-date.

Several questions are swirling:

- Will China introduce more new regulation and in what areas?

- What companies could be targeted next?

- What does it mean for growth of the tech sector in China?

CNBC tackled some of this in a recent episode of the “Beyond the Valley” podcast below. Those conversations will continue at East Tech West.

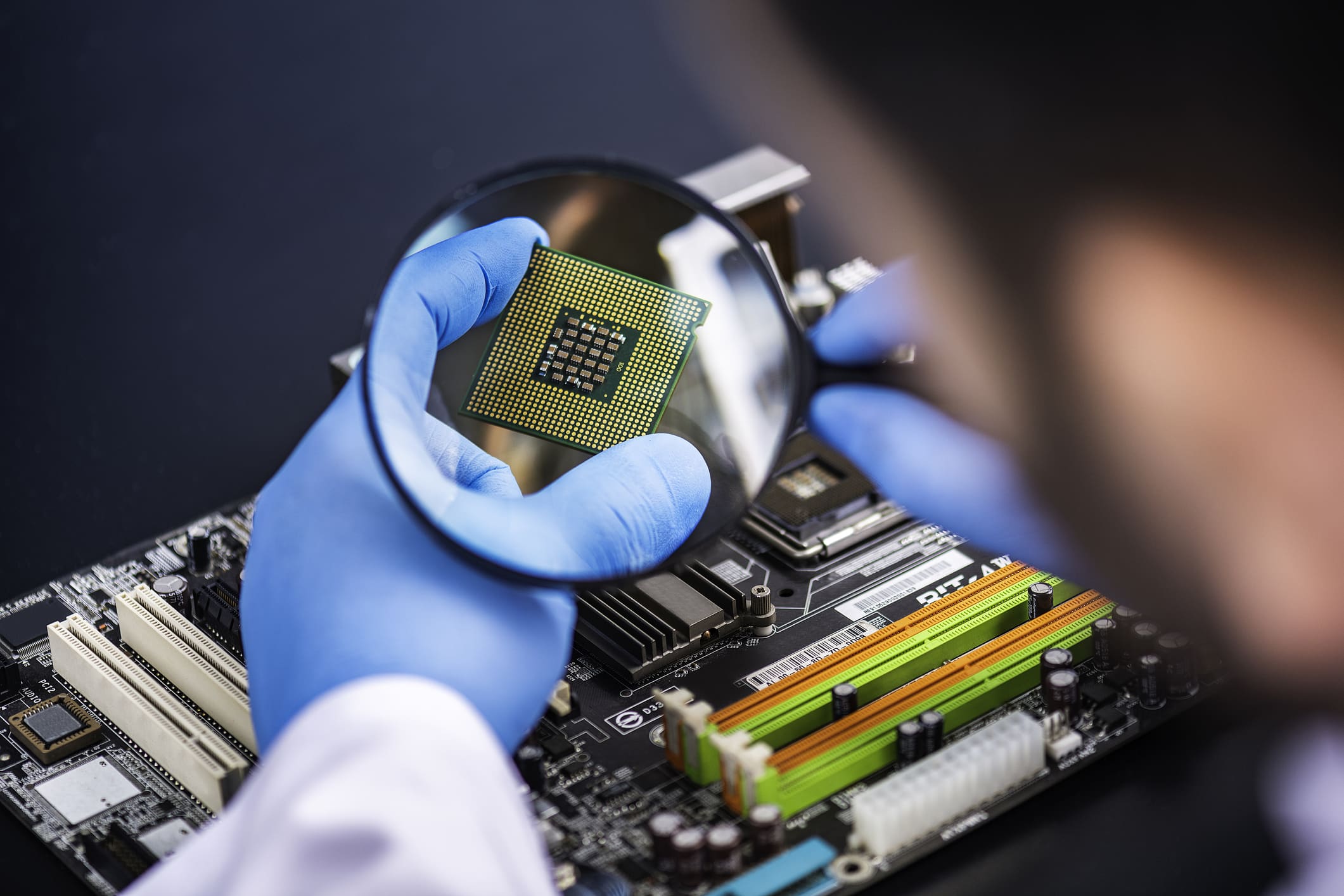

Semiconductors

The continuing technology rivalry between the U.S. and China has added urgency to Beijing’s push for increased self-sufficiency across a variety of sectors. One of those is semiconductors, which are critical for everything from cars to mobile phones.

But China is struggling to catch up with the U.S. and other countries, and that’s because of the complexity of the semiconductor supply chain, which is dominated by foreign companies.

A good example is the field of chip manufacturing. SMIC, which is China’s largest contract chip manufacturer, is several years behind Taiwan’s TSMC and South Korea’s Samsung. SMIC is actually unable to manufacture the latest cutting-edge chips required for leading smartphones.

Foreign companies dominate the most advanced tools and equipment required for the manufacture of high-end chips. U.S. sanctions have denied China access to some of those tools. Chinese companies can’t compete.

How China will boost its domestic chip industry in the face of those hurdles is a major, ongoing debate.

Read more on semiconductors

‘Frontier’ tech

The semiconductor industry is just one of many industries where China is trying to boost its credentials.

In its five-year development plan, the 14th of its kind, released earlier this year, Beijing said it would make “science and technology self-reliance and self-improvement a strategic pillar for national development.”

The plan identifies areas which Beijing sees as “frontier technology” — artificial intelligence (AI) and space travel.

China has made notable progress in space, including launching its own space station. It has ambitions to send its first crewed mission to Mars in 2033.

When it comes to artificial intelligence, Chinese technology giants from Baidu to Tencent are investing heavily.

Electric vehicles

Another area that China is emphasizing — and one which investors know well — is electric vehicles. The industry is part of its drive to reduce emissions and pledge to become carbon neutral by 2060.

For several years, the Chinese government has supported the development of so-called new energy vehicles through subsidies and other favorable policies. That has led to tens of thousands of companies entering the industry, though many have never produced a single car.

About 1.1 million electric vehicles were sold in the first half of this year, nearly as many as were sold in all of 2020, according to market research firm Canalys. China is the world’s largest electric vehicle market.

That growth has attracted lots of new players with a technology background. Xiaomi, which is known for smartphones, expects to mass produce its own electric vehicles in the first half of 2024, while search giant Baidu has set up its own electric car business with Chinese automaker Geely.

Read more on electric vehicles

China’s economic slowdown

China’s technology giants now are having to cope with a slowing Chinese economy.

A number of factors including power shortages and efforts to rein in debt-fueled expansion in the real estate sector have added to other economic challenges, such as sluggish consumer spending.

It’s starting to filter through into corporate financial results. Alibaba slashed its revenue guidance for the current fiscal year.

Tencent Chief Strategy Officer James Mitchell said on the company’s earnings call that he expects advertising to “remain soft for several quarters due to macro challenges and regulations affecting certain key advertising sectors.”