WASHINGTON — The coronavirus pandemic has slowed work on the first ViaSat-3 broadband satellite, making a launch in mid-2021 unlikely, Viasat CEO Mark Dankberg said Aug. 7.

Speaking during an earnings call for the quarter ended June 30, Dankberg said the pandemic continued to weaken demand for inflight connectivity services, but did not have as strong an impact as feared on Viasat’s overall financial performance.

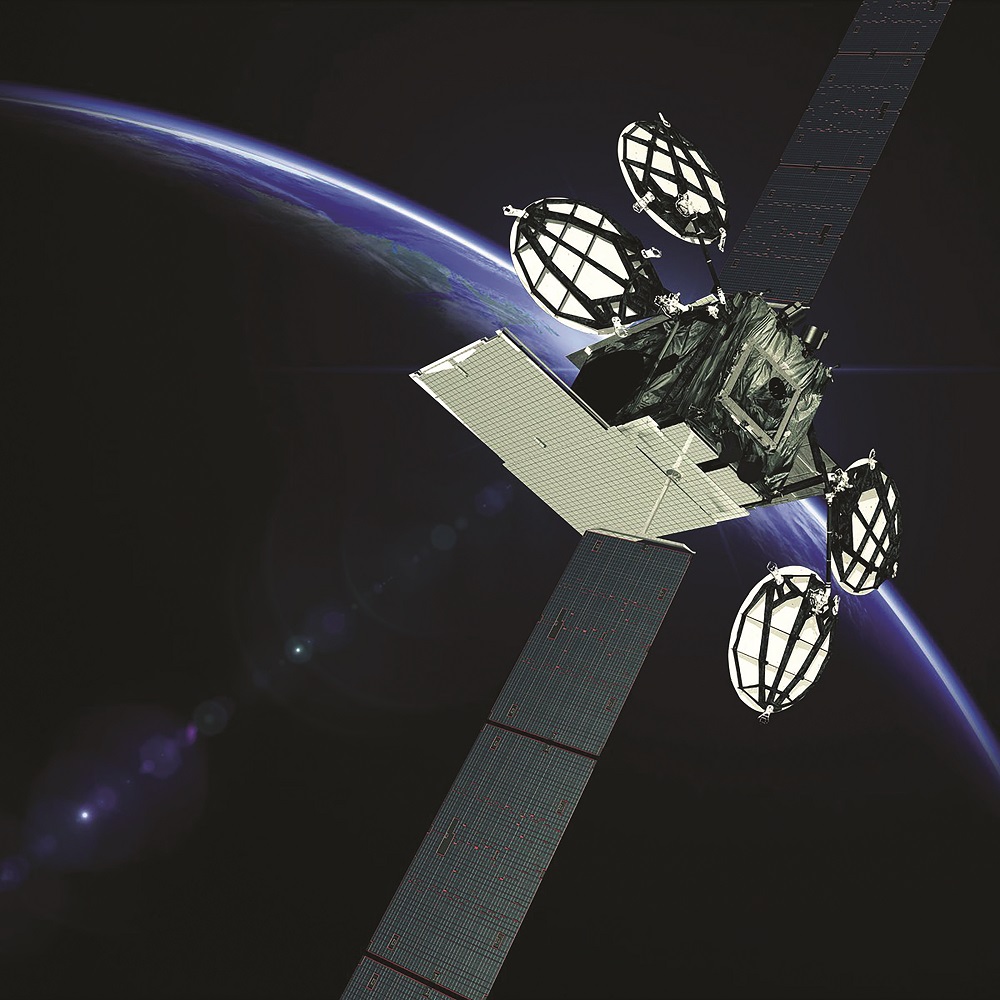

Demand for residential broadband and government connectivity grew during the quarter, and should continue to climb once the first ViaSat-3 satellite, designed to beam a terabit or more of capacity over North and South America, is in orbit, he said.

Viasat is building the payloads for all three ViaSat-3 satellites in-house, and expects to ship the first payload to manufacturer Boeing later this year for integration into a 702 platform, Dankberg said. Viasat blamed earlier payload delays on an unnamed component supplier.

That satellite should still launch by the end of 2021, he said, but lacks a more specific launch date until the payload shipment.

“We were aiming for being able to ship that payload at around the time we report next quarter,” Dankberg said. “It doesn’t look like we will have shipped it by then.”

Viasat has launch contracts for all three ViaSat-3 satellites it and Boeing are building — one for a SpaceX Falcon Heavy, one for an Arianespace Ariane 6, and one for a United Launch Alliance Atlas 5 — but has not stated the order in which the missions will occur.

In the meantime, Viasat provides broadband services through its fleet of three satellites, ViaSat-2, ViaSat-1 and WildBlue-1, and with capacity leased on partner satellites. The company reported $530.5 million in revenue for the months of April, May and June, down $6.5 million from the same quarter in 2019.

Dankberg, in an Aug. 7 letter to shareholders, said around 630 aircraft with ViaSat terminals installed were inactive during the quarter, down 45%, and that passenger Wi-Fi use on flying planes was also low.

Residential broadband subscribers grew, however, up 9,000 to 599,000 total with customers choosing higher-tiered internet plans, he wrote. Average revenue per user passed $99, up 18%, as pandemic-induced transitions to work-from-home and school-from-home environments drove demand for household satellite internet, he said.

Viasat won $334 million in new government contracts during the quarter, and secured two indefinite-delivery, indefinite-quantity contracts collectively worth almost $2 billion if fully used.

Dankberg said Viasat is making headway with military customers by winning over buyers in the special forces division of each service branch.

“A lot of our business is not in what are called programs of record,” he said. “It’s really showing operational capabilities that are so important or valuable that our customer base is figuring out how to allocate money to acquire that stuff.”

Viasat ended the quarter with $232 million in cash and cash equivalents, and on July 23 raised $175 million in equity from shares sold to Intercorp and Viasat’s largest shareholder, The Baupost Group. Dankberg said the funds give Viasat more “maneuverability” including potentially for strategic transactions to help the company extend its geographic footprint, gain new technologies or otherwise deepen its presence in different markets.