TAMPA, Fla. — Space logistics company D-Orbit said Aug. 12 it has canceled plans to go public by merging with Breeze Holdings Acquisition Corp, a special purpose acquisition company (SPAC).

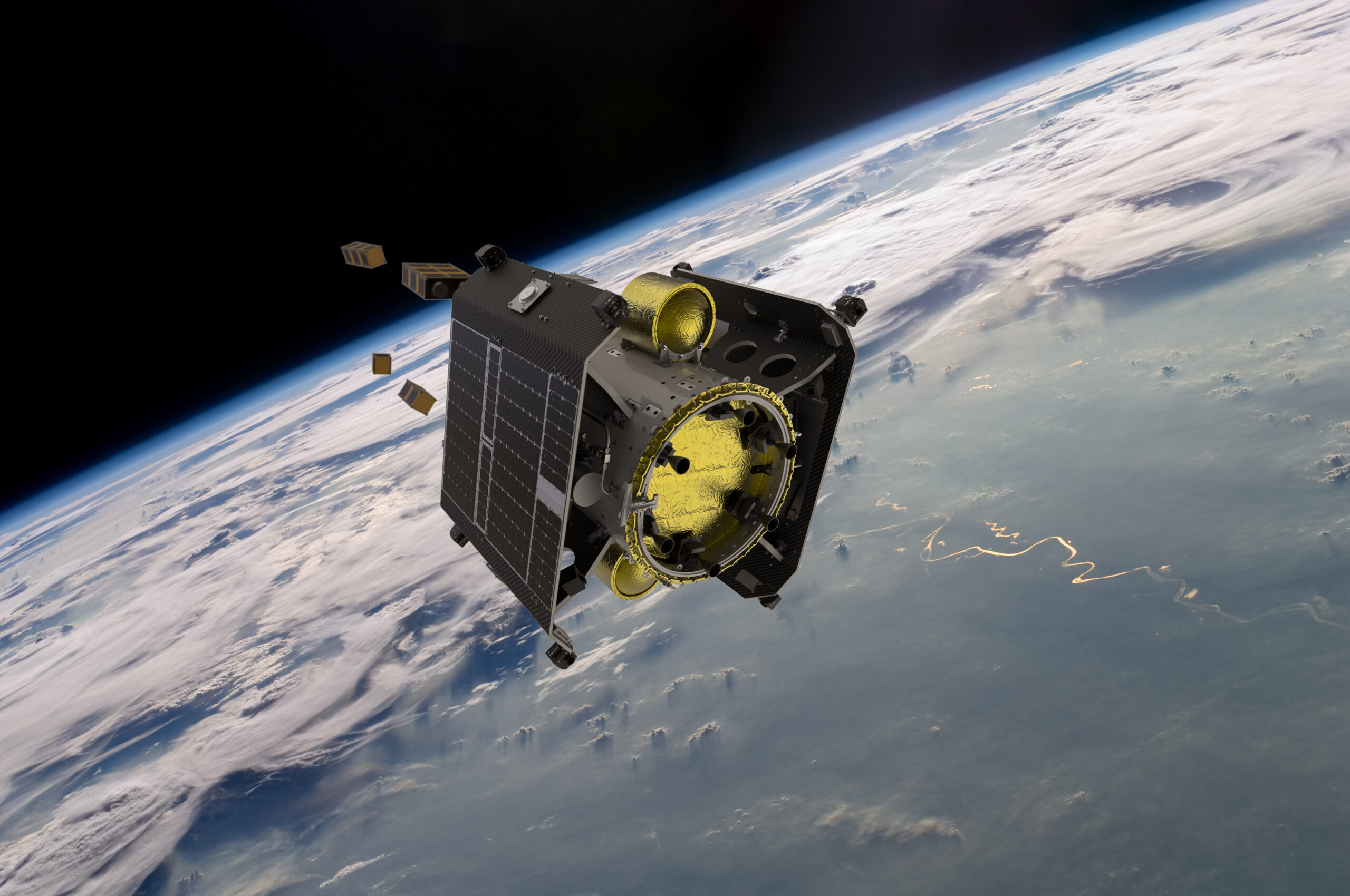

The Italian company had hoped to raise $185 million from the deal to expand staff and accelerate investments in ION Satellite Carrier, its orbital transfer vehicle (OTV) that completed its first commercial mission in late 2020.

However, “financial markets have changed substantially” since the deal was announced Jan. 27, Breeze CEO Douglas Ramsey said, amid rising interest rates, soaring inflation, and an ongoing war in Ukraine.

“As we look ahead, we remain focused on identifying another value creating opportunity for Breeze shareholders,” Ramsey added.

D-Orbit’s growth trajectory remains on track despite market conditions “beyond our control,” its CEO Luca Rossettini said in a statement.

The company said it has delivered more than 80 customer payloads to their orbits so far this year with three ION missions, and is set to fly another three ION missions before the end of the year.

Last week, D-Orbit announced a deal to launch 20 nanosatellites over three years for Swiss startup Astrocast with ION.

D-Orbit spokesperson Caterina Cazzola said “our plan to go public is simply on hold for now and when the time is right, we will review the opportunity for a public listing and the best strategy of doing so.”

SPACs falling out of favor

A rough macroeconomic backdrop also led to U.S.-based Tomorrow.io canceling plans in March to accelerate its constellation of commercial weather radar satellites with a SPAC merger.

SPACs are shell companies that use money raised from listing on a stock market to merge with another company, offering them a cash infusion and a fast track to the public market for future growth.

However, there are questions over whether early-stage space companies are a good fit for public investors because their businesses are typically capital-intensive and subject to delays.

Of the nine space companies that went public through SPAC mergers in 2021, only Rocket Lab’s shares finished the year trading above their price when the merger closed.

Demand for new SPAC deals has also been waning amid declining investor appetite for risk and increasing regulatory scrutiny over how these blank check firms operate.

More than 40 SPAC mergers have been canceled so far this year, reported Bloomberg.

In the space sector, satellite communications equipment maker Satixfy is continuing to work toward closing its SPAC merger this year.

Satisfy announced its deal to combine with Endurance Acquisition Corp March 8, the day after Tomorrow.io scrapped its SPAC merger plan over market conditions.