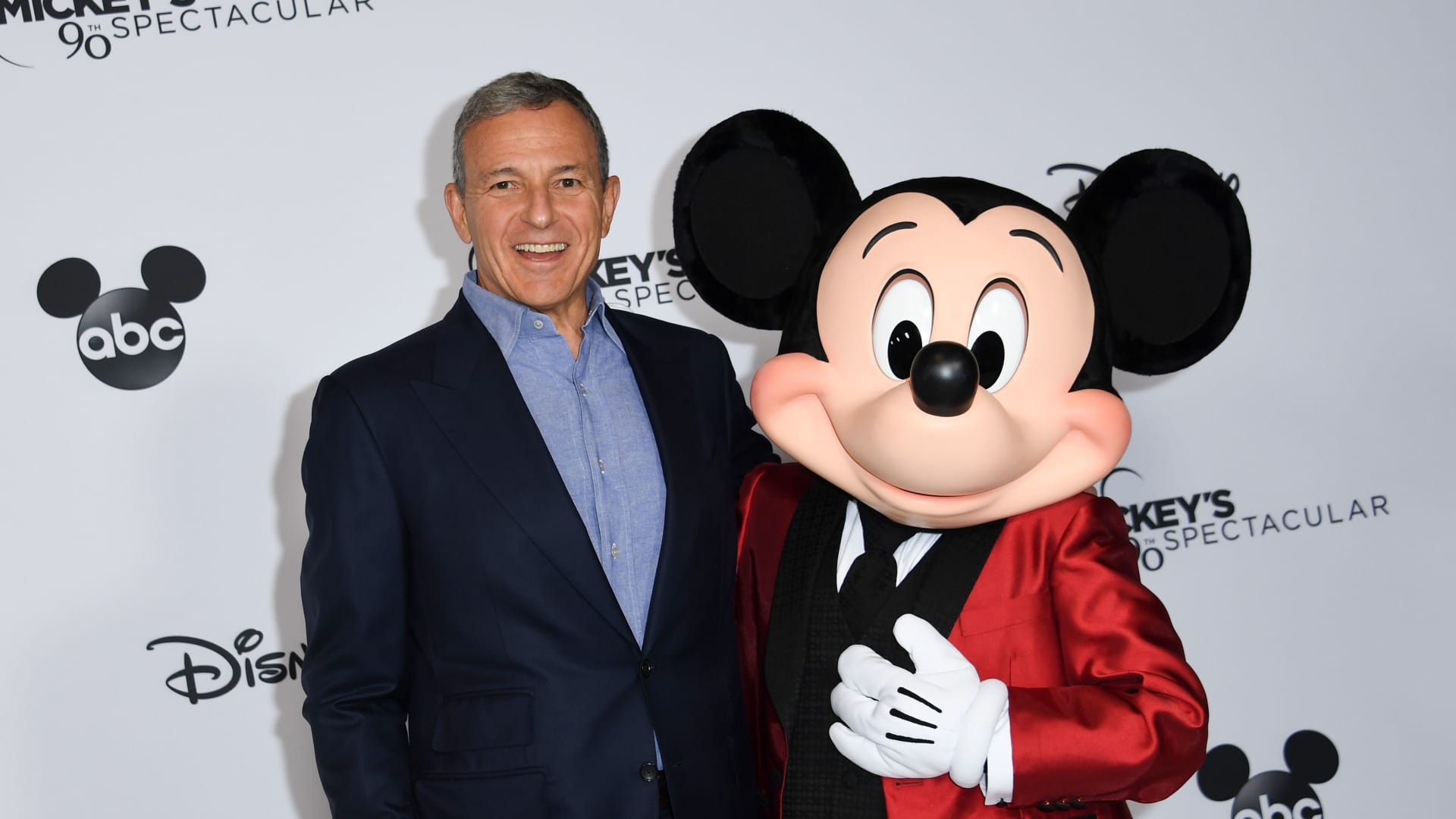

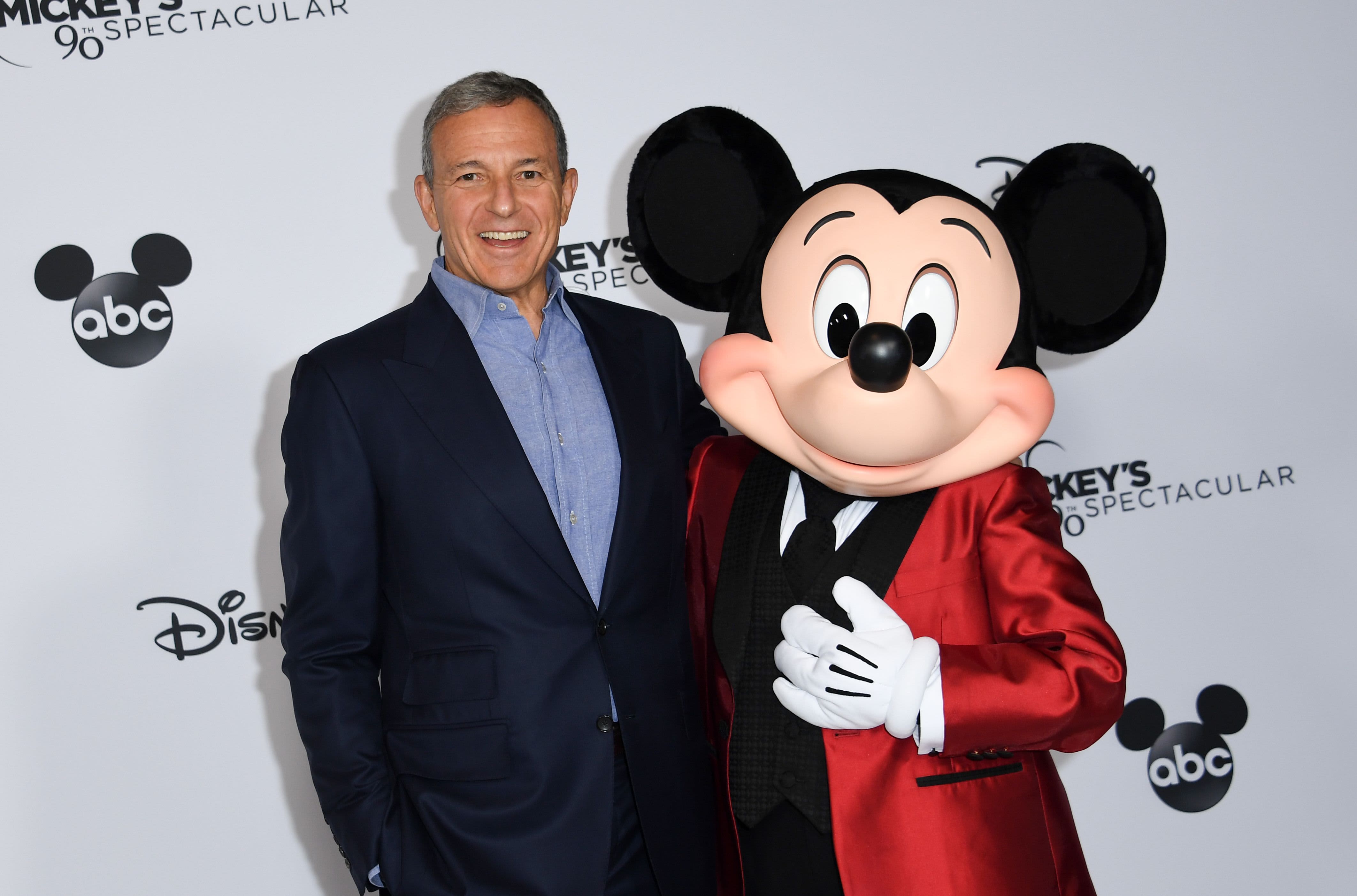

LOS ANGELES – While shareholders will still be keyed in to see how many subscribers Disney’s suite of streaming services added during the fiscal first-quarter report, the focus of Wednesday’s earnings will be the return of CEO Bob Iger.

His reinstatement coincides with a contentious proxy battle with activist investor Nelson Peltz and follows a rough year for the company’s stock, as soaring streaming costs and a slim slate of theatrical releases ate into profits.

related investing news

This is Iger’s first earnings call since early 2020, and his words will set the tone for the future of the media company. Investors are eager for details about his plans to rework the company’s structure.

Since his return, Disney’s stock has outperformed almost every member of the Dow Industrials. Shares of the company have risen around 20%, matching Dow Inc., and just below Boeing. Additionally, Disney’s gain is about five times that S&P 500’s 4% rise during the same period.

Here’s what analysts expect:

- Earnings per share: 78 cents expected, according to a Refinitiv survey of analysts

- Revenue: $23.37 billion expected, according to Refinitiv

- Disney+ total subscriptions: 161.1 million expected, according to StreetAccount

Last quarter, with Bob Chapek still at the helm, Disney sought to temper investor expectations for the new fiscal year, forecasting revenue growth of less than 10%. As part of that warning, the company noted that its Disney+ platform may see a tapering of growth going forward.

In November, the company reported $1.5 billion in operating losses at its direct-to-consumer unit, which includes its streaming services. This quarter, Wall Street is predicting a slightly smaller loss of $1.2 billion.

As for subscriber growth, analysts predict the total Disney+ user pool will be 161.1 million, a loss of around 3 million compared to the previous quarter. The expectation is that a recent price hike prompted some consumers to drop the service.

Revenue and operating income at Disney’s theme parks could be up year-over-year considering the holiday season typically drives significant foot traffic to its domestic and international amusement locations. Additionally, the company released the blockbuster hit “Avatar: The Way of Water” in theaters in December, likely boosting its theatrical revenues year-over-year.