PARIS — A top official with the U.S. Export-Import Bank says the export credit agency is considering proposals for more than $5 billion in satellite industry financing.

Speaking at the World Satellite Business Week conference, Judith Pryor, first vice president and vice chair of the board of directors of Ex-Im, said the bank was interested in helping the industry finance new projects while remaining agnostic about specific architectures or technologies.

She said the bank was reviewing $1.3 billion in financing proposals “likely to come to fruition” within the year. An additional $4 billion in deals are “a little less further along,” she added.

She did not identify any specific proposals that the bank was reviewing, other than there were “more than a handful” under consideration. In June, Declan Ganley, chief executive of Rivada Space Networks, said his company was seeking Ex-Im financing for its satellite constellation, which includes a $2.4 billion contract with satellite manufacturer Terran Orbital and several hundred million dollars more in launches from SpaceX.

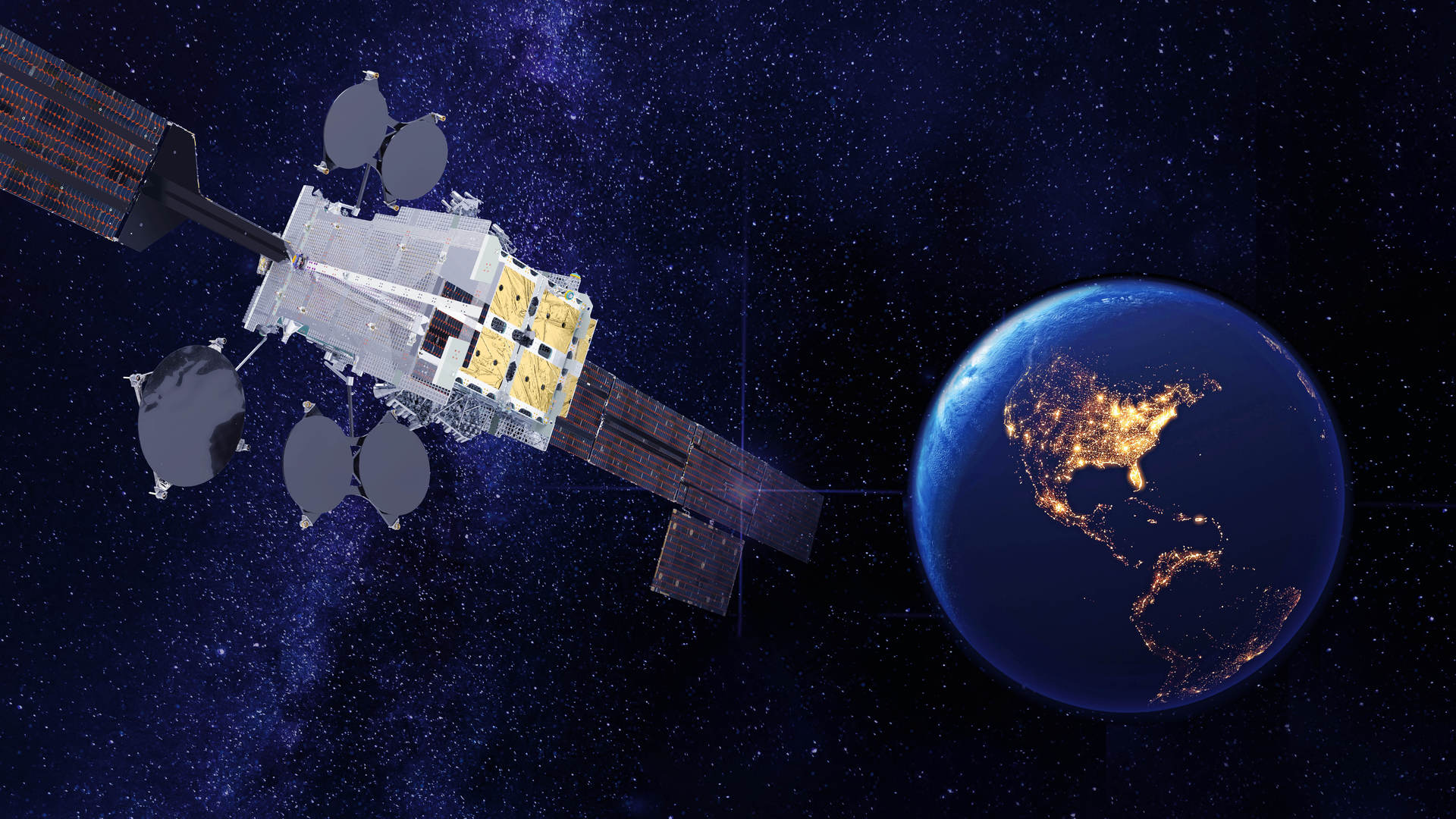

Pryor said that Ex-Im was considering a range of proposals. “What we see at Ex-Im are less GEO and more LEO megaconstellations. Certainly that’s the way the industry is heading,” she said. The bank has also seen proposals for Earth observation and other “new space” systems, she added.

What Ex-Im has financed recently, though, has been in GEO. In 2021, Ex-Im financed the SpaceX launch of a Hispasat communications satellite, valued at $80.7 million. In late 2022, the bank approved $407 million in financing for the launch by SpaceX and United Launch Alliance of two ViaSat-3 satellites, a project done through Viasat’s United Kingdom subsidiary.

One of those satellites, ViaSat-3 Americas, suffered a problem with its antenna after launch that may jeopardize its ability to provide broadband services. Pryor said she didn’t have any additional details about the problem beyond what Viasat has reported but that Ex-Im was in discussions with the company about the status of the spacecraft.

She emphasized the bank would not play favorites with specific technologies or companies. “As a U.S. government agency we need to remain agnostic,” she said. “If there is an interested buyer of a U.S. export, whether it be a SpaceX launch or ULA, we can finance those launches.”

She said the bank had plenty of capacity to consider additional deals: it has a lending cap of $135 billion but only $34 billion in current exposure. “We don’t write checks to everybody, but if it’s a viable business project, let’s take a look,” she said.

That included new markets, like orbital debris removal. “There will be a time when we can start to consider financing on-orbit elements,” she said. “If you have a viable business model and a plan, we’ll take a look at it.”