There’s an emerging industry thought to be only science fiction not too long ago that’s close to becoming a reality: space tourism.

And a handful of companies – including one publicly traded name – are competing neck and neck to be leaders in the emerging market.

But what space tourism entails, and how much it costs per person, varies greatly depending on a company’s technological capabilities. For example, both Virgin Galactic and SpaceX expect to fly private paying passengers to space next year. But, while passengers flying with both companies would go to space by the Federal Aviation Administration’s definition, a Virgin Galactic passenger spends about 0.04% as much time in space as on a SpaceX trip, while a ride with Elon Musk’s company is expected to cost roughly 200 times as much.

Whether a passenger reaches suborbital and orbital space is the major difference in the destinations of the human spaceflight offerings in development. Because of that difference, there are notable distinctions in the cost, experience and even risk of what it means to be a space tourist.

UBS in a report last year estimated that space tourism, with both suborbital and orbital together, has a potential market value of $3 billion by 2030. More recently, space industry consultancy Northern Sky Research broke out its expectations for suborbital versus orbital tourism. By 2028, NSR expects suborbital will be a $2.8 billion market, with $10.4 billion in total revenue over the next decade, while orbital will be a $610 million market, with $3.6 billion in total revenue over the next decade.

Here’s how the small but growing market breaks down, and which companies are involved in each area.

Suborbital tourism

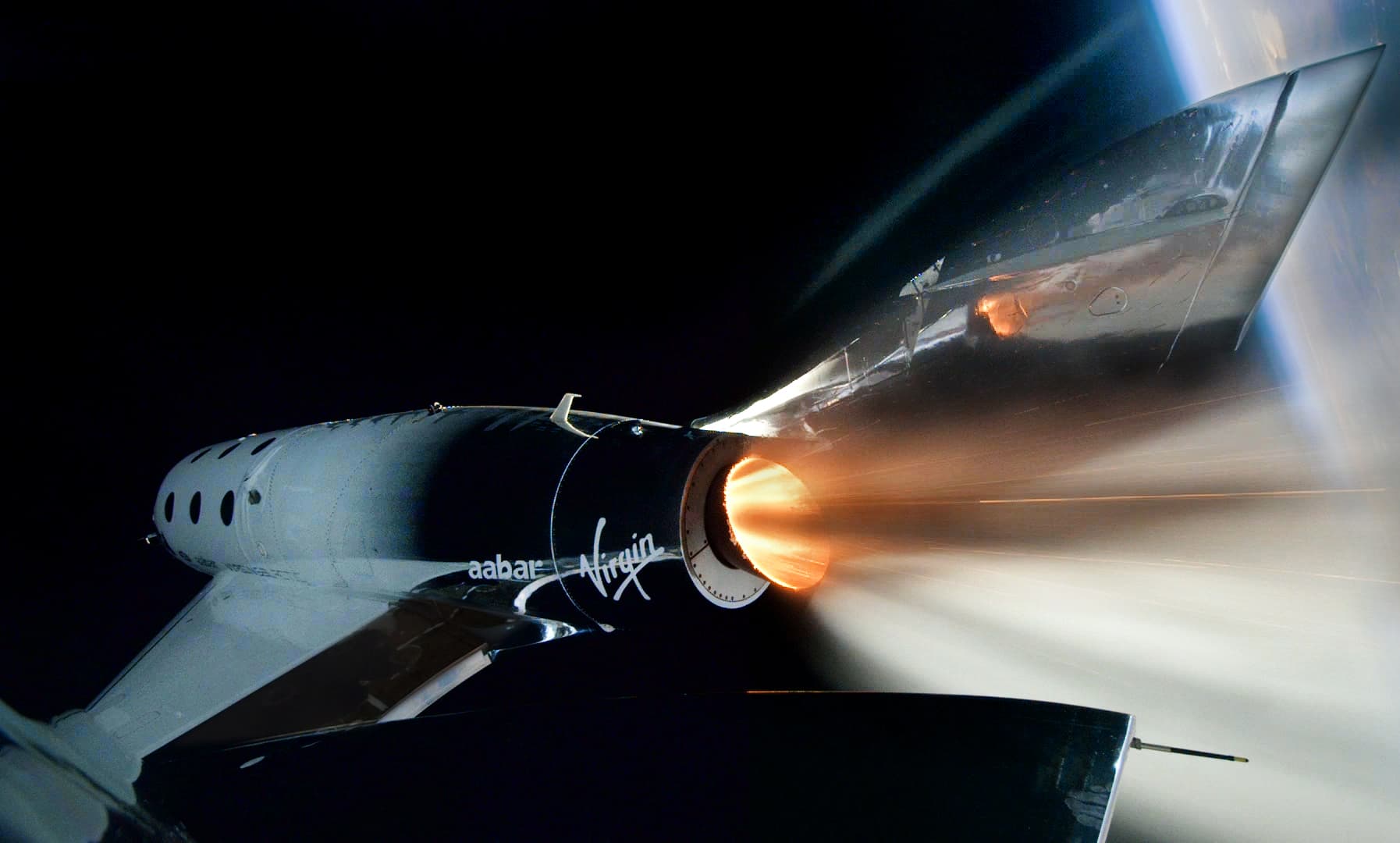

Virgin Galactic’s spacecraft Unity reaches space for the first time.

Source: Virgin Galactic

There are two companies competing in the realm of suborbital tourism: Virgin Galactic, which debuted on the public market last year and trades under the ticker “SPCE,” and Blue Origin, the private space company funded almost entirely by Amazon founder Jeff Bezos.

Both of the companies’ systems are rocket-powered and capable of carrying up to six passengers on a flight, but that is where the similarities end.

Virgin Galactic’s spacecraft SpaceShipTwo, which has two pilots in addition to the passengers, is docked underneath a jet-powered carrier aircraft known as WhiteKnightTwo. With the spacecraft attached, the carrier aircraft takes off from a runway and climbs to an altitude of more than 40,000 feet. Then the spacecraft is dropped, free-falling briefly before firing its rocket motor and ascending to an altitude of about 295,000 feet, or roughly 90 kilometers. The spacecraft essentially does a slow back flip at the edge of space, with passengers spending a few minutes floating in microgravity, before it re-enters and then glides back to land on its runway in New Mexico. The company reuses the spacecraft, replacing the hybrid rocket engine and reconnecting it to the carrier aircraft.

Virgin Galactic’s spacecraft Unity glides in for a landing after a flight test in New Mexico on June 25, 2020.

Virgin Galactic

Blue Origin’s more traditional rocket New Shepard launches with a domed capsule on top of the about 60 foot tall booster. It ascends straight up, with the capsule separating near the top of the flight and reaching an altitude of more than 330,000 feet, or about 100 kilometers. There the capsule floats for a few minutes in microgravity before returning back to Earth, slowing down using a system of parachutes to land in the West Texas desert floor.

Blue Origin launches a New Shepard rocket from its facility in Texas.

Blue Origin | gif by @thesheetztweetz

But unlike conventional rockets, New Shepard’s booster also comes back to land separately – with the company reusing the boosters for future launches.

Blue Origin’s New Shepard rocket booster lands after its eleventh successful mission.

Blue Origin

Virgin Galactic has sold about tickets to about 600 passengers at a price between $200,000 and $250,000 each, although the company expects it could increase its prices substantially for the first commercial flights. Blue Origin has said its ticket pricing is yet to be determined, but Bezos expects his company will price flights on New Shepard comparable to competitors.

To date Virgin Galactic has flown five people to space on two test flights. All five are company employees, with four pilots controlling the spacecraft and chief astronaut trainer Beth Moses riding along as a test passenger on the second flight. The company expects to conduct two more test spaceflights before it flies founder Richard Branson, which is planned for the first quarter of 2021 and will effectively mark the beginning of Virgin Galactic’s commercial service. Blue Origin, on the other hand, has yet to fly passengers on New Shepard despite completing 12 missions in the past few years. The company’s CEO Bob Smith earlier this year said New Shepard will need to fly three or four more test flights before Blue Origin puts people on board.

Additionally, Virgin Galactic has said that passengers will spend three days training before a flight, while Blue Origin expects its passengers will train for just one day.

Blue Origin’s New Shepard rocket launches from the company’s facility near Van Horn, Texas in June 2016.

Blue Origin

Given the price point of the flights, both Virgin Galactic and Blue Origin are targeting high net worth individuals for the suborbital experiences. Virgin Galactic chief space officer George Whitesides has previously categorized space tourism flights as an “out-of-home luxury experience,” which is the fastest-growing part of the luxury market. And, when Blue Origin also begins flying passengers, Whitesides said he thinks both companies will have more than enough demand for flights.

“Globally, we think around 2 million people can experience this over the coming years at this price point. Over time, we’ll be able to reduce that price point and at that point the market just explodes. It’s 10 times as many at 40 million people,” Whitesides said last year.

Cowen and UBS have each recently conducted surveys of high net worth individuals and their interest in suborbital tourism. Cowen’s survey exceeded Whitesides’ estimation, as the firm found suborbital flights have a total addressable market of about 2.4 million people among individuals with a net worth of more than $5 million. UBS surveyed more than 6,000 high net worth individuals specifically on flying with Virgin Galactic. About 20% of those UBS surveyed said they are “likely to purchase a ticket on a spacecraft within 1 year” of the company beginning regular flights. That number increases to between more than 35% “after several years of safe operation,” UBS said.

Additionally, UBS highlighted how much Virgin Galactic’s space tourism market expands as the price comes down. The firm estimated that there are about 1.78 million people with a net worth of more than $10 million but there are about twice that many with a net worth between $5 million and $10 million – and about 37.1 million people with a net worth between $1 million and $5 million.

Orbital tourism

A SpaceX Falcon 9 rocket about to launch the company’s Crew Dragon spacecraft is seen before the Demo-2 mission with NASA astronauts Robert Behnken and Douglas Hurley onboard.

NASA/Joel Kowsky

Unlike suborbital, which reaches an altitude of about 100 kilometers (or 330,000 feet) and gives passengers a few minutes in space, orbital missions reach an altitude of over 400 kilometers (or 1.3 million feet) and spend days or even more than a week in space. To date, orbital space tourism has largely been limited to a few flights to the International Space Station that used Russian Soyuz spacecraft.

But SpaceX, with its Falcon 9 rocket and Crew Dragon capsule, has now entered the orbital tourism arena. This summer SpaceX launched and returned two NASA astronauts with its spacecraft for the first time ever, in a mission that was historic for both Musk’s company and the U.S. space agency. The test flight made SpaceX the first private company to send people to orbit, a feat only previously achieved by government superpowers.

The SpaceX launch system is similar to Blue Origin’s, but with a more powerful rocket and a larger capsule. Its Crew Dragon spacecraft is built to hold as many as seven passengers and sits on top of the company’s 230 foot tall Falcon 9 rocket booster. Launching from NASA’s Kennedy Space Center in Florida, it takes the spacecraft several hours to reach either the ISS or its intended orbit. NASA astronauts on the recent Demo-2 mission described riding in SpaceX’s capsule as “a little bit smoother” than the Space Shuttles of the past, which were “a little bit rougher, at least at the beginning.”

Even before that Demo-2 mission launched, SpaceX had already signed two separate agreements with companies looking to fly private paying passengers to space. While NASA’s astronauts spend months up at the ISS, the private missions will be only about 10 days at most. While SpaceX hasn’t disclosed specifically how much each of the current contracts are worth, previously announced contracts mean that it will likely cost about $50 million per person to fly with Crew Dragon.

In addition to the launch costs, a 10-day mission to the ISS would rack up a $350,000 bill with NASA. Under the agency’s cost structure unveiled last year, NASA would get $35,000 a night per person, as compensation for the agency’s services a tourist would need while on board the ISS.

But Crew Dragon likely won’t be the only option for private passengers to get to the ISS in the coming years. While testing delays mean the spacecraft remains in development, Boeing’s Starliner capsule is also designed to carry as many as seven passengers. And, under Boeing’s contract with NASA to fly four astronauts at a time, the company is allowed to sell the fifth seat to prospective space tourists. A Boeing spokesperson told CNBC on Friday that the company has a team actively looking to sell that fifth seat.

A United Launch Alliance Atlas V rocket with Boeing’s Starliner spacecraft onboard is seen as it is rolled out.

NASA | Joel Kowsky

Finally, Crew Dragon and Starliner are likely to remain the two best options for orbital tourists, SpaceX is also working on its next-generation Starship rocket. It’s the company’s top priority, as Musk wants to build a fully reusable rocket system that can launch cargo or as many as 100 people at a time. But, while SpaceX has signed a deal to fly Japanese billionaire Yusaku Maezawa around the moon with Starship in 2023, Musk noted earlier this month that the rocket will have to complete “hundreds of missions with satellites before we put people on board.”

SpaceX’s first Starship prototype under construction near Boca Chica, Texas in 2019.

SpaceX

Orbital brokers and services

In addition to the handful of companies building rockets and spacecraft that fly people, there are a few that also help find interested passengers and get them ready to launch. Space Adventures, Axiom Space and Virgin Galactic each offer some variation of orbital space tourism services, although the companies don’t build or launch spacecraft that go to orbit.

Over the past two decades U.S.-based Space Adventures has flown seven tourists using Russian spacecraft. At a reported cost of more than $20 million per person, the private clients typically spent over a week on board the the ISS. Most recently, Space Adventures signed one of the two deals announced with SpaceX. Using a Crew Dragon capsule, Space Adventures plans to have SpaceX fly four tourists on a “free-flyer” mission to orbit, meaning they won’t dock with the ISS but instead will orbit the Earth for five days before returning. The mission is expected to launch between “late-2021 to mid-2022,” with Space Adventures saying that training would take “a few weeks.”

SpaceX’s Crew Dragon “Endeavour” docked with the International Space Station.

NASA

Houston-based start-up Axiom Space signed the other deal with SpaceX, to fly a professionally-trained commander and three passengers to the ISS in October 2021 using Crew Dragon. It will be a 10 day mission, with two days of travel and eight days on board the space station. In this case Axiom acts as more than just a broker, providing all the services necessary – from training to management and more.

While Axiom has not confirmed who the members of the crew will be, NASA in May announced that it is working with actor Tom Cruise to film a movie on the ISS. And, while the agency did not confirm Cruise is flying with Axiom or SpaceX, Musk tweeted that the mission “should be a lot of fun!” On Wednesday, space industry publication Spaceflight Now reported that Cruise will be one of the passengers on an Axiom mission.

Axiom also confirmed this month that it is working with a U.S. television production company called Space Hero for another 10 day trip to the ISS. Scheduled for 2023, Space Hero said it plans send the winning contestant of a reality TV show to the space station, with Axiom training the crew and managing the mission.

Finally, while Virgin Galactic doesn’t plan to develop an orbital spacecraft, the company signed an agreement with NASA that sets the company “up to become a player in the provision of that service,” it said. Since signing the agreement, Virgin Galactic said it now has “deposit agreements” for orbital spaceflights with 12 customers, although it has yet to finalize pricing.

“We expect pricing to be competitive with other offerings in the market,” Whitesides told investors during the company’s most recent quarterly earnings call.

Watch the video above to learn more about the space tourism market.

Subscribe to CNBC PRO for exclusive insights and analysis, and live business day programming from around the world.