Getting gig economy workers to send their paychecks directly to a PayPal or Venmo wallet is one of the goals of a new partnership between PayPal and Fiserv announced Wednesday.

As digital wallets become more popular, the deal between the two fintech companies is focused on giving consumers faster access to payouts and businesses new marketing opportunities on the Venmo platform.

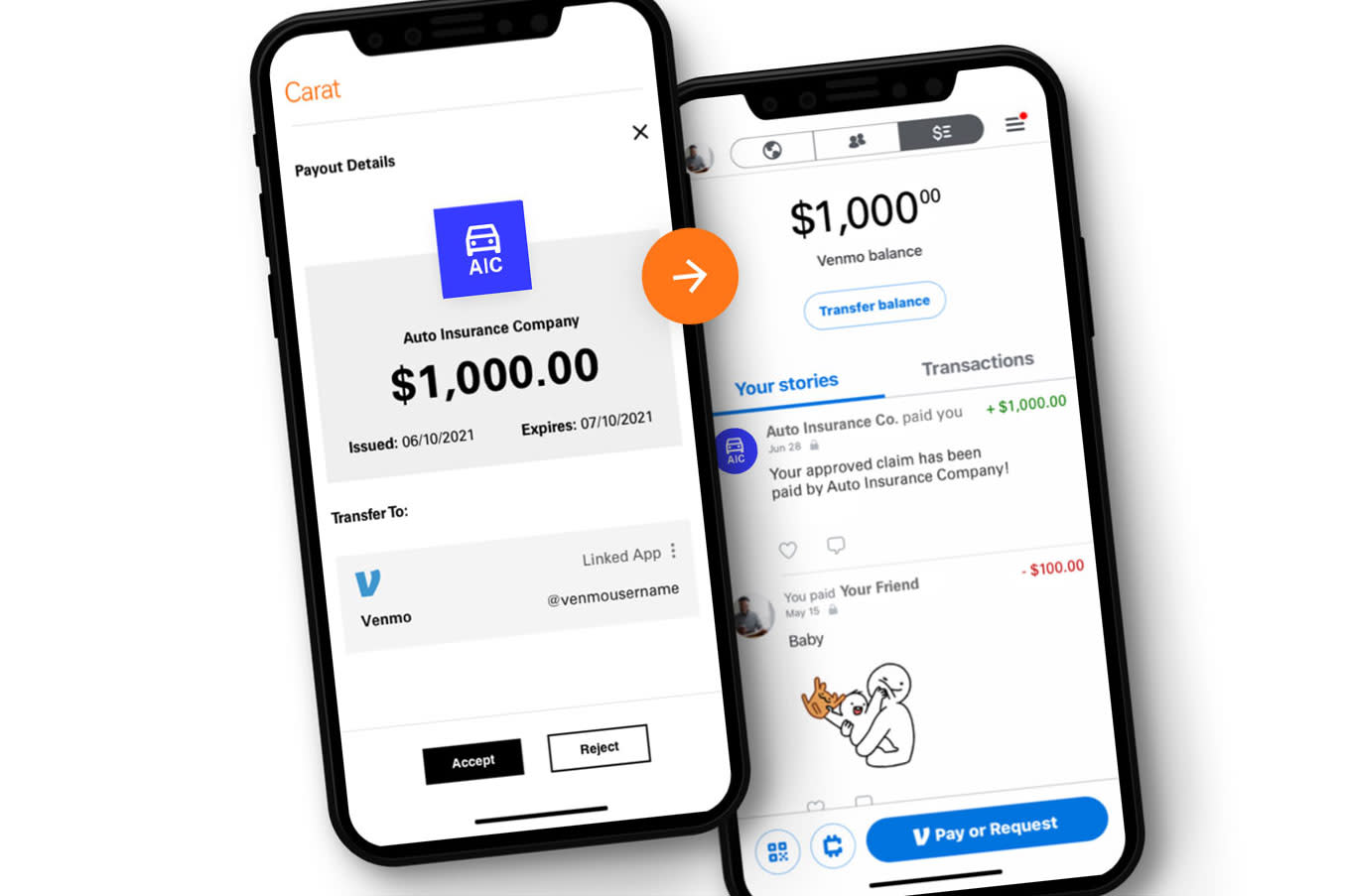

“The use cases that this can support are a 1099 (independent contractor) payment for a gig economy worker, a claim payment for an insurance company, a tax refund from the federal government and more.” Nandan Sheth, global head of payments at Fiserv, told CNBC before the release. “It’s a combination of convenience and real-time payment experience combined together for the consumer.”

“With more than 400 million active accounts on the PayPal and Venmo platforms, we are able to provide companies with a fast, easy, and cost effective way to send money.” Dan Leberman, senior vice president of partnerships for Paypal, said in a release. “This integration is the next step in our long-standing partnership with Fiserv and will provide substantial value to enterprises that need to send money directly to customers.”

Lyft, State Farm and FanDuel are current Fiserv customers that have access to the technology immediately, and the company says it is in active discussions to enable payments directly to Paypal and Venmo. In May, Fiserv and State Farm announced a partnership that allows direct transfer of insurance claim payouts to customer bank accounts.

“It’s really interesting with ride-share, drivers can literally get paid after the ride,” Sheth said, “The benefit the company gets if they use the Venmo rails is the logo of that company is embedded in the payment. It appears on the users social graph with a message. It gives brands an opportunity to get in front of the Venmo audience. It’s a two-part value proposition.”

If consumers embrace depositing business-to-consumer payments onto platforms like Paypal, Venmo and Cash App, the partnership has the potential to disrupt the way consumers bank, according to Dominick Gabriele senior fintech and specialty finance analyst at Oppenheimer. Currently 94% of employees have their check sent directly to a bank account through direct deposit according to American Payroll Association. In the first quarter of 2021, nearly $5 trillion was deposited into non-interest-bearing accounts like a checking account, according to the FDIC.

“It’s sticky. It’s automated so the chances of you taking the time to switch that around are very low,” Gabriele told CNBC. “And you link other accounts, you are opening a debit card with that institution, you might open a credit card with that institution because that is where your money is.”

“There is nothing stopping networks like this from traversing from B2C to B2B.” Sheth said, “So the ramifications of what is going on in the industry with nontraditional payment methods kind of overlapping with what the banks are doing and their ability to get mindshare of the consumer is a megatrend.”