U.S. government debt prices were lower Monday morning amid renewed optimism that a coronavirus aid package could be agreed in the coming weeks.

At around 2 a.m. ET, the yield on the benchmark 10-year Treasury note rose to 0.7573% while the yield on the 30-year Treasury bond was up at 1.5435%. Yields move inversely to prices.

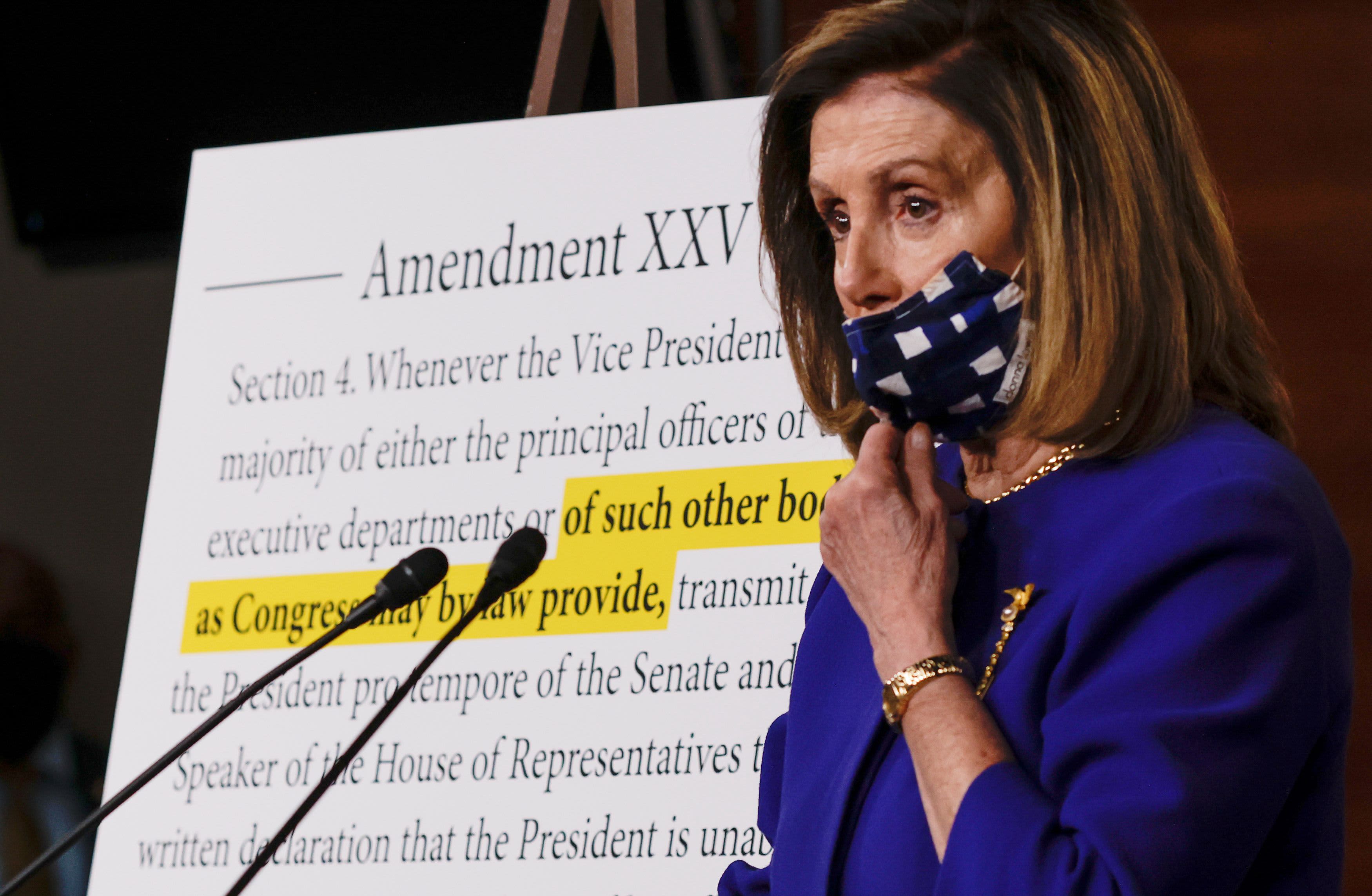

House Speaker Nancy Pelosi said Sunday that although differences remain between congressional Democrats and White House negotiators, she was optimistic about pushing through legislation on a fiscal stimulus deal before the Nov. 3 election.

However, concerns remain over the current surge in Covid-19 cases across the U.S. A CNBC analysis of Johns Hopkins University data showed Covid-19 cases were growing by 5% or more in 38 states as of Friday, with the daily case average nationwide rising by more than 16% week on week to nearly 55,000.

There are no major economic data releases Monday, but investors will be monitoring Federal Reserve Chairman Jerome Powell’s speech at 8 a.m. ET.

Auctions will be held Monday for $54 billion of 13-week Treasury bills and $51 billion of 26-week bills.