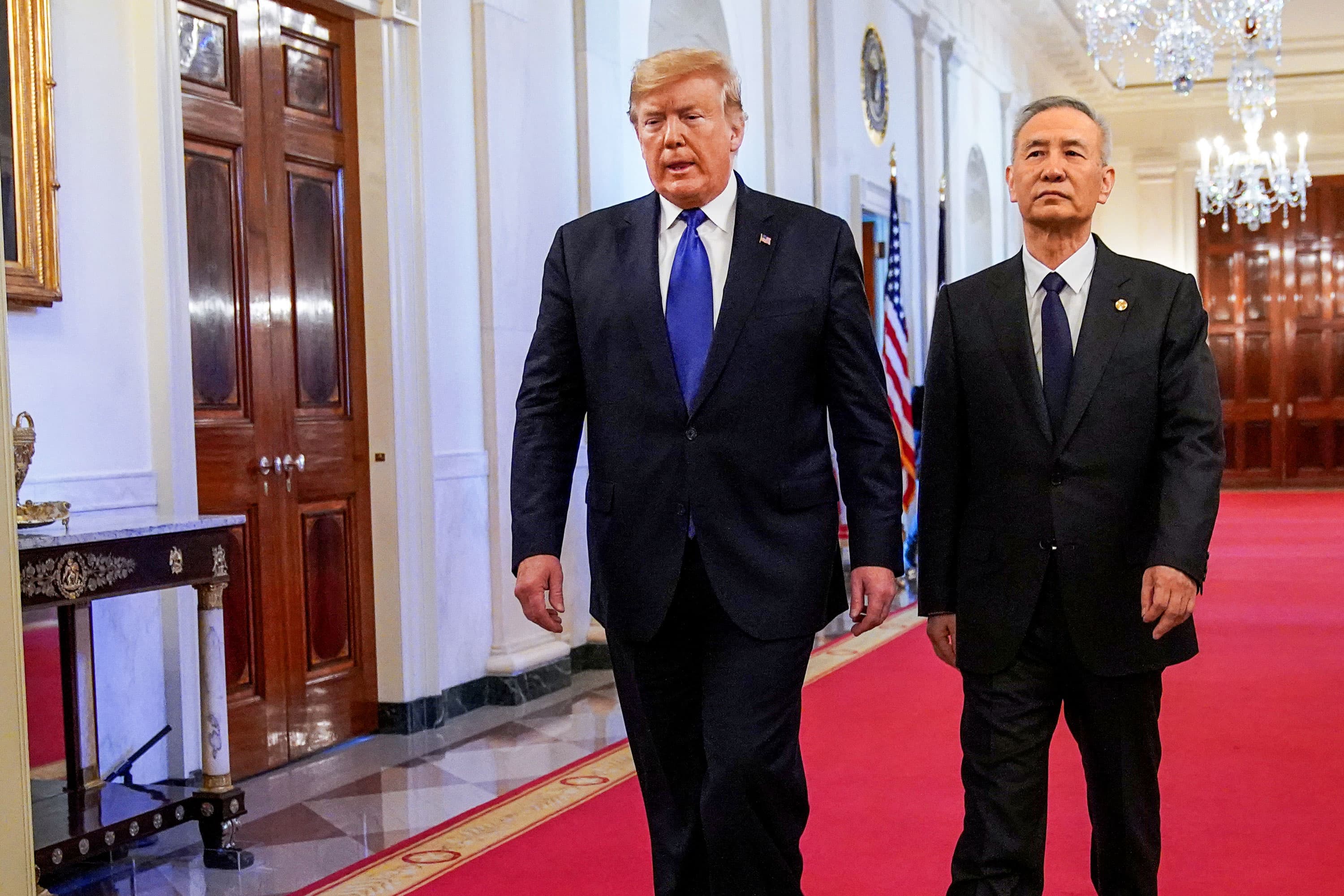

Chinese President Xi Jinping and U.S. President Donald Trump in Beijing, China.

Artyom Ivanov | TASS | Getty Images

WASHINGTON — President Donald Trump said he would hold a news conference “on China” on Friday, but he offered no details as to what he would say.

Even without any details, Trump’s announcement Thursday at the White House was enough to send markets tumbling.

Between 3:15 p.m., when news of the Friday presser hit wires, and the 4:00 p.m. close of the trading day, the Dow Jones Industrial Average fell 300 points, giving up its positive gains for the day and ending down half a percent.

The White House did not immediately respond to questions from CNBC about the content of tomorrow’s presidential announcement.

For weeks, the Trump administration has been ratcheting up pressure on Beijing over its alleged cover-up of early coronavirus cases, and Trump has publicly blamed China both for the virus itself and for its outsized severity in the United States.

Beijing, in turn, has suggested the virus originated in U.S. service members, a claim widely refuted by international health experts.

In the past week, however, the pressure from the United States has taken a more serious turn in response to a proposed Chinese security law that threatens the long-standing independence of Hong Kong. The law was formally approved Thursday by China’s People’s Congress, and it is expected to criminalize most forms of political protest under blanket bans on “sedition” and “subversion.”

On Wednesday, Secretary of State Mike Pompeo delivered a report to Congress declaring that Hong Kong was no longer autonomous from China.

“No reasonable person can assert today that Hong Kong maintains a high degree of autonomy from China, given facts on the ground,” Pompeo said in a statement accompanying the report.

The shift in Hong Kong’s status immediately jeopardizes the former British colony’s favorable trade relationship with the United States, which has so far meant that Hong Kong has been spared punishing tariffs that are a hallmark of Trump’s trade war with mainland China.

The State Department was required to issue a determination on Hong Kong’s autonomy under pro-democracy legislation passed by Congress late last year. The law also requires that Trump impose sanctions on foreigners who undermine “fundamental freedoms and autonomy in Hong Kong.”

For investors, a revocation of Hong Kong’s favored status is a worst-case outcome of Friday’s news conference. But it’s far from guaranteed.

Trump has so far been reluctant to take action on China that could tip the strained bilateral relationship into an outright confrontation. As president, Trump is acutely aware of the United States’ interdependence with China as both a market for American exports and a supplier of manufactured goods. He also still believes that his Phase One trade deal, signed in January, can and will be seen as one of the high points of his presidency, fulfilling a key campaign promise he made in 2016.

Likewise, since the coronavirus first arrived in the U.S., Trump has shown little appetite for signing any legislation he thinks could hinder the economic recovery.

But this could all change Friday.

On Wednesday, the House overwhelmingly approved a Senate bill that would require Trump to submit reports to Congress identifying Chinese government officials it believes are responsible for the forced detention of up to 2 million ethnic Muslims, known as Uyghurs, in Xinjiang.

The Uyghur Human Rights Policy Act of 2020 condemns the Chinese Communist Party for its treatment of Uyghurs, and it requires the State Department to conduct a detailed assessment of the human rights violations occurring in Xinjiang and submit it to Congress. The bill passed the House 413-1.

Despite the bill’s veto-proof majority in both chambers, Trump has yet to indicate whether he will sign it, another subject that could come up at Friday’s news conference.

If Trump were to sign the Uyghur bill on Friday, for example, but not take formal steps to revoke Hong Kong’s favored status, this would likely be viewed as a more cautious approach and be welcomed by investors.

Another potential issue that Trump could raise Friday is the ongoing border dispute between China and India, which Trump has offered to mediate. On Thursday, Trump said he had spoken to Indian Prime Minister Narendra Modi about the dispute. “He’s not in a good mood,” Trump said of Modi.

There are other factors Trump is reportedly weighing with regard to China, which are bigger than any one policy position. One is the rising anti-China public sentiment in the United States.

Trump’s reelection campaign is trying to capitalize on the growing number of Americans who say they have an unfavorable view of Beijing.

Attack ads aimed at presumptive Democratic nominee Joe Biden portray him as too friendly to China, and there’s an effort to stick the former vice president with the moniker “Beijing Biden.”

As Trump’s reelection campaign tries to paint his opponent as “soft on” China, Trump, by contrast, needs to appear tough on China. So far, this has been achieved chiefly through tweets.

On Friday, Americans will get a chance to see if there’s a bite behind Trump’s China bark.

— CNBC’s Tucker Higgins and Tom Franck contributed to this report.