Jonathan Raa | Nurphoto | Getty Images

Trump Media on Friday warned the CEO of the Nasdaq Stock Market of ‘potential market manipulation’ of the company’s stock by “naked” short selling of shares.

The warning came two days after Trump Media, which owns the Truth Social app, offered shareholders detailed instructions on how they can avoid lending their shares to short sellers, who then execute trades betting that the price of the stock will fall.

Trump Media disclosed its warning to Nasdaq CEO Adena Friedman in a filing with the Securities and Exchange Commission.

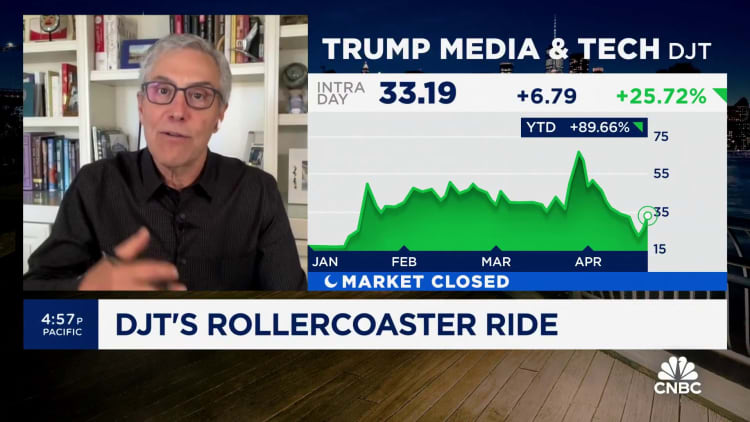

The price of Trump Media stock, ticker symbol DJT, has rallied in recent days but, trading at about $36 per share Friday afternoon, is still sharply lower than the more than $70 per share it debuted at on March 26.

Former President Donald Trump owns nearly 60% of Trump Media shares. The paper value of his stake has dropped by billions of dollars since the stock began public trading in March.

Trump Media CEO Devin Nunes in his letter to Friedman did not directly accuse anyone in particular of naked short selling, which is the sale of stocks without first having borrowed such stocks for that purpose.

But Nunes noted that as of Wednesday “DJT appears on Nasdaq’s ‘Reg SHO threshold list,‘ which is indicative of unlawful trading activity.”

“This is particularly troubling given that ‘naked’ short selling often entails sophisticated market participants profiting at the expense of retail investors,” Nunes said.

However, the SEC on its website notes that a failure to deliver shares as part of a short sale trade, which can land a company on the Reg SHO threshold list, does not necessarily reflect improper trading activity such as naked short selling.

“There are many justifiable reasons why broker-dealers do not or cannot deliver securities on the settlement date,” the SEC notes in a section about Regulation SHO.

But in his letter, Nunes pointed to circumstantial evidence, which included Trump Media stock being in early April the most expensive stock to short in the United States, which he said would give brokers “significant financial incentive to lend non-existent shares.”

The letter links to a CNBC article detailing the sky-high premiums brokers were charging short sellers for loans of Trump Media shares to sell.

“I write to bring your attention to potential market manipulation of the stock of Trump Media & Technology Group Corp.” Nunes wrote.

“As you know, ‘naked’ short selling â selling shares of a stock without first borrowing the shares of stock deemed difficult to locate â is generally illegal pursuant to Securities and Exchange Commission (‘SEC’) Regulation SHO,” he wrote.

“Data made available to us indicate that just four market participants have been responsible for over 60% of the extraordinary volume of DJT shares traded: Citadel Securities, VIRTU Americas, G1 Execution Services, and Jane Street Capital,” Nunes wrote.

DJT price for past month

“In light of the foregoing, and Nasdaq’s obligation and commitment to protect the interests of retail investors, please advise what steps you can take to foster transparency and compliance by ensuring market makers are adhering to Reg SHO, requiring brokers to disclose their ‘Net Short’ positions, and preventing the lending of shares that do not exist,” Nunes wrote.

“TMTG looks forward to assisting your efforts.”

A Nasdaq spokesperson told CNBC, “Nasdaq is committed to the principles of liquidity, transparency, and integrity in all our markets.”

“We have long been an advocate of transparency in short selling and have been an active supporter of the SEC’s rules and enforcement efforts designed to monitor and prohibit naked short selling,” the spokesperson said.

A spokesperson for Citadel Securities told CNBC, “Devin Nunes is the proverbial loser who tries to blame ‘naked short selling’ for his falling stock price.”

“Nunes is exactly the type of person Donald Trump would have fired on ‘The Apprentice,'” the spokesperson said, referring to Trump’s former reality business competition show.

“If he worked for Citadel Securities, we would fire him, as ability and integrity are at the center of everything we do,” the spokesperson said.

A spokeswoman for Trump Media in response to that said, “Citadel Securities, a corporate behemoth that has been fined and censured for an incredibly wide range of offenses including issues related to naked short selling, and is world famous for screwing over everyday retail investors at the behest of other corporations, is the last company on earth that should lecture anyone on ‘integrity.'”

A spokesman for Virtu Financial, the parent company of Virtu Americas, declined to comment.

G1 Execution Services and Jane Street Capital had no immediate comment on Nunes’ letter.

Data from FactSet shows that the short volume in Trump Media shares has not significantly changed since April 7, while the stock price sharply dropped before seeing a pointed bounce in recent days.

Short volume is the number of tradable shares being sold short during a specific period.

The data suggests that there was no change in the pattern of short selling that affected the price of Trump Media shares during that same time.

Trump, the presumptive Republican presidential nominee, currently is on trial in New York state court on criminal charges related to a 2016 hush money payment by his then-lawyer to the porn actor Stormy Daniels.

Correction: This article has been updated to correct the spelling of Adena Friedman’s name.

Read the original article here